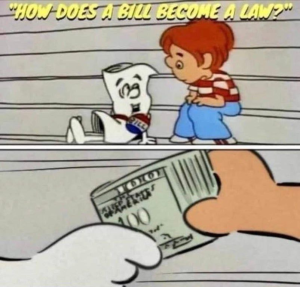

The video, above, found on the internet, clearly explains, to

every federal law enforcement and regulatory agency, why

these people should be arrested!

Answer: You make sure that the “bad guys” will never, ever, win: Because, now, with global crowd-sourced forensic AI-based software and pro bono global publishing centers (provided free to tens of millions of citizens), their deeds, done in the dark, will always, eventually, come to light. Then, you cut off the stock market bribe payments of every single politician involved in the scam with new, and harsh, laws and penalties for their crimes! Did you see all of those politicians recently getting indicted and/or retiring from politics? The FBI and FINCen now have tracking spreadsheets showing all of the bribe payment routes from stock-market-to-Congress-to-policy-manipulation! We are most of the way there! Happy New Year!

OPPORTUNITY NOTICE TO LAW FIRMS:

We are currently suing, have sued, or are preparing to sue, each and every government agency, politician, corporation and individual who engaged in the attacks and crimes that harmed us. We have won all of our cases, so far, and/or had many defendants arrested, indicted, fired or sued by the FBI, DOJ, SEC, FTC, IRS or other government entity. We have set new legal precedents and created new federal laws designed to destroy this kind of corruption. Our peers are pushing a huge number of anti-corruption bills through Congress. LAWYERS!!! Qualified law firms may contract with us to sue the other outstanding defendants and prepare new cases on a percentage-of-recovery contingency basis. High quality dossiers exist on each defendant, portions of which were developed by the FBI, DOJ and Congressional investigators. Because the defendants have been doing the “bad things” as recently as yesterday, they never run out the clock on the statute of limitations.

————————-

The United States Patent Office, public records, NDA’s, document leaks and hundreds of other sources say that we built and deployed the first companies and technologies that Google, Facebook, YouTube, Netflix, Tesla and the Silicon Valley cartel are based on. Those companies, and their oligarch bosses, never paid to use our products.

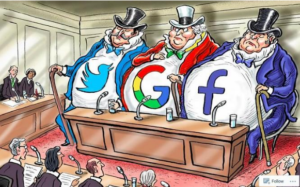

Google, Facebook, YouTube, Netflix, Tesla and the Silicon Valley cartel spend billions of dollars a year, in collusion, in order to manipulate elections so that they can put candidates in office who will kick-back government treasury funds to those companies.

The FBI, GAO and other forensic investigators have proven that Google, Facebook, YouTube, Netflix, Tesla and the Silicon Valley cartel are owned by almost all of the top Senators and political officials in California and those Senators and political officials steer billions of dollars worth of investigation blockades (protecting these corrupt companies), tax breaks, contracts and other exclusive gifts to those crony insider companies that they own. That is why criminally corrupt social manipulator: Google, has not been exterminated…yet!

Billions of citizens have railed against the failure of Congress to regulate or punish these companies for their corruption and harms to society. The truth is that many in Congress won’t allow Google, Facebook, Tesla, etc., to be punished because Congress people make most of their profits off payola from these crooked companies. It is mobster-ism!

So you have a little pack of Silicon Valley companies, coordinated by the NVCA, that rig elections, buy Senators that are supposed to represent us and destroy our Democracy. Together they hire Gawker, Gizmodo, Fusion GPS, Media Matters, Black Cube, In-Q-Tel, BellTroX, Citizen Intel, Bluehawk CI, Cytrox, Cognyte, Axciom, Cobwebs Technologies, NSO Group, Match Group and hundreds of other cyber-attack and cyber-mercenary groups. These brand-murder-for-hire attack groups were contracted by California politicians and their tech oligarch financiers. These groups are now under investigation by the FBI, IRS, Interpol and special investigators. This horde of ‘attack services’ get paid by Senators staffers to “take out” competitors using intelligence agency “dirty tricks” operatives…Not good, right? We would like to see the Senators and tech bosses that use these attack services end up in jail and be forced to pay for the collusion-based damages they caused.

‘Big Tech’ Cartel companies: Google, YouTube, Netflix, Tesla, Facebook, et al, coordinated to hire the same little coordinated group of lawyers, CPA’s, lobbyists, opposition research attack services, paid-under-the-table “reporters” and CPAC managers. This created an FBI-prosecutable “Enterprise” as defined by the RICO Racketeering laws. This ‘Enterprise’ coordinated political campaign funding and internet manipulation to the exclusive benefit of this ‘Enterprise’ and paid payola, in stocks, to corrupted, and famous, political figures who assisted them. In FCC, DOE and EPA contracts, grants, tax waivers and insider regulation blockades, almost every person at those agencies held stock in, or was paid and/or hired, by this Cartel. That is a felony abuse of public resources!

Our proof is based on the investigation records of the most potent intelligence agencies, federal super cops and investigative journalists in the world. We would love to have a public jury trial or a live televised Congressional ethics hearing to present all of the evidence to the public….but those don’t seem to be allowed because it would shame some famous, and corrupt, politicians. ie: RICO SUSPECTS 12 9 21

Thanks to our friends at 3-Letter agencies, top journalists and those organizations at the bottom of this post: These kinds of deeds, done in the dark, will always come to light if the “bad guys” cross swords with us!

“Famous politicians and their Big Tech financiers joined forces to manipulate government funds, and stock market rigged “pumps” into their own pockets in the last two “stimulus” funds.

There has never been so much taxpayer cash given to so few people, where each, and every, one of the recipients was a friend of the politicians. Those who got the cash immediately skimmed “unjust stock market profits” with it and paid kick-backs to the politicians.

Almost every competitor to the insiders, was attacked and sabotaged using state and federal resources. The victims demand justice and restitution for the government investment fraud, loss of years of their lives under a false federal pretext, harassment and interference they suffered. The victims seek to be compensated for the malicious, proven, retribution tactics, lies, toxic exposures, vendetta cut-offs of all earned government funds and benefits, tort-based interference, “missing hard drives” and interdiction efforts conducted, with applicants own tax dollars, against the applicants.

This is a felony-class slush-fund crime that has cost taxpayers trillions of dollars in losses and has cost Plaintiffs many tens of millions of dollars in damages and losses.

Big investment banks like J.P. Morgan, Goldman Sachs, et al. coordinated these schemes with money laundering, tax evasion, offshore covert funds and other financial trickery. FinCEN, Interpol, FBI, GAO, and most other investigators, have proof of these assertions but they have been stalled from making arrests. The money-tracks go right back to the politicians families from the bank accounts of Google, Facebook, Tesla, Netflix, Sony Pictures, etc; forensic accounting records. Government agencies were in charge of making sure these crimes did not happen but they chose to ‘steal instead of serve’! They chose to help these crooks ‘cheat instead of compete’!

The politicians that the taxpayers EMPLOY do not get to make hundreds of millions of dollars in crooked profits off of government funds that are supposed to help citizens under duress. They won’t let us have a jury trial or a live Senate hearing because they know they will lose and they will be shamed!

They dug their own graves and now it is up to the voters to bury them in the next election!…”

You have probably heard of “The Offshore Leaks”, “The Panama Papers”, “The Pandora Papers”, “The Swiss Leaks”, “The Sony Pictures Hack”, “The Luanda Leaks”, “The Bahamas Leaks”, “The Paradise Papers“, etc. from the www.ICIJ.org investigations. A number of organizations have now taken the tax and financial records from all of those leaks and put the data in a massive cross-referenced database. They then plugged the names of all of the families of the tech oligarchs and the main politicians in America into the search process of that database (Like XKeySCORE). The results are as shocking, terrible and as ‘Game Of Thrones’ as you might suspect. Those organizations will be reporting on that throughout 2022.

You may have seen a number of big politicians suddenly announce that they are retiring. It is because of that database. They are so CAUGHT!

You have seen that there is a surge of Silicon Valley executives getting arrested for bribery. There will be nearly 1000+ more arrests, our friends at DOJ, FBI, CIA, INTERPOL and SEC tell us!

The Congressional political corruption in those leaks made the Mob look like school-boys. Now we are ENDING POLITICAL CORRUPTION IN AMERICA FOREVER!

Here is how YOU can end political corruption in America, too: ENDING POLITICAL CORRUPTION IN AMERICA (BOOK)

What you might not know is that EVERY bank and international CPA firm has been hacked. Different state agencies, seeking to embarrass each other, have a leaking war going on. The public has only seen 10% of what the international journalists (Like ProPublica, ICIJ, Transparency International, The Guardian, etc.) have in their hands. The three videos on this page explain the whole ruckus. ( A.- How Political Corruption Works, B. – ABC-TV Plus, C. – The Elon Musk Story )

The Government hired a team to build America’s back-up energy plan “in case the Middle East had problems”. The Government convinced them to invest years of their time and their life savings in this Government sponsored program. At the last minute, the government didn’t pay what they had promised that team and sent the money, instead, to a White House political campaign financier oligarch. Federal and news investigators later discovered that the oligarch, and his staff, were sleeping with, giving jobs to and paying the White House staff that made all of the funding decisions. It was felony-class organized crime.

It is a tough pill to swallow to find out that your own Senators and elected officials are either financed by, friends, with, sleeping with, dating the staff of, holding stock market assets in, promised a revolving door job or government service contracts from, partying with, personal friends with, photographed at private events with, exchanging emails with, business associates of or directed by; our business adversaries, or the Senators and politicians that those business adversaries pay campaign finances to, or supply political digital search manipulation services to. Criminal U.S. Senators coordinated and profited in these schemes. Their own family members have now supplied evidence against them to federal authorities. Imagine finding out that Senator So-And-So secretly owned your competitor, fed them exclusive inside information, helped them run hit-jobs on you, their constituent, and got them exclusive funding!!!!

It may surprise you to learn that the #1 way to bribe a politician, especially a Senator, is with stock market shares. Some politicians are only supposed to get paid about $100K but they make $100M with stock market shenanigans arranged for them by the people they are selling graft to.

DEMAND THAT IT BE AGAINST THE LAW FOR ANY POLITICIAN, OR THEIR FAMILY, TO OWN STOCKS AND: 1.) MOST POLITICAL CORRUPTION WILL END, 2.) CROOKED WEASELS WILL STOP RUNNING FOR OFFICE, 3.) REGULAR PEOPLE WILL GET THE GOVERNMENT SERVICES THEY EXPECT.

Any politician that tries to prevent laws that stop criminal stock market bribes is a lying criminal who is getting stock market bribes from Google, Tesla, Netflix, Facebook and the rest of the big tech cartel!

This news article describes the key insider trading and political bribery of the matter:

Sen. Elizabeth Warren blasts ‘brazenness’ of California lawmakers who flouted a federal law meant to stop congressional insider trading and the utter lack of federal enforcement

- Sen. Elizabeth Warren called out the “brazenness” of California lawmakers who flouted a federal disclosure law in order to hide the bribes they took from insider trading.

- An Insider investigation found that dozens of members of Congress violated the STOCK Act.

- The “Conflicted Congress” project found members of Congress trading stocks in industries they’ve criticized.

Said one of the witnesses: “…I was a White House And Congressional Advisor. I was asked to participate in a criminal stock market manipulation, involving stimulus funds, that public figures had put together. I reported the crime. Federal officials then ran reprisal attacks on me using taxpayer-paid resources. According to the FBI and Congressional investigators, they spent over $30M buying media attacks. Now I want my damages, losses and monies-owed paid and I want the FBI to reveal what they found out from interviewing the attackers (ie: their 302 forms) because that reveals who paid the attackers. The feds defrauded me out of my life savings and got me to invest in their project that they had already covertly hard-wired to some Senator’s Big Tech financiers. Now the Feds have blockaded my rights to a lawyer, a jury trial and coverage of my damages, as political reprisal for speaking out…”

Sen. Elizabeth Warren denounced the “brazenness” of members of Congress who have flouted a federal law meant to stem insider trading in Congress and called for stronger enforcement in response to a new Insider investigation.

“Conflicted Congress,” a five-month Insider investigation, found 48 members of Congress and 182 senior-level congressional staffers have violated the “STOCK” Act. The 2012 federal conflict-of-interest law requires members and staff to disclose their stock trades and seeks to prevent those in the halls of power from personally cashing in on the information they learn behind closed doors.

The investigation found dozens of cases of lawmakers trading stocks in industries and companies, like big tech firms, pharmaceutical companies, and fossil fuel producers, that they directly oversee or have publicly criticized.

“We need both tougher laws and enforcement of those laws,” the Massachusetts Democrat told Insider in an interview at the Capitol. “The American people should never have to guess whether or not an elected official is advancing an issue or voting on a bill based on what’s good for the country or what’s good for their own personal financial interests.”

Warren called out the “brazenness of people who think it’s okay to be in a position of trust to represent the people of this country, and at the same time to be working to advance your own financial interests,” adding, “it’s just wrong.”

When it comes to financial wrongdoing, Congress acts as its own policeman, resulting in little accountability and massive cover-ups in many cases.

Warren, a consumer protection lawyer who taught at Harvard Law School, has consistently advocated for stronger financial transparency requirements for members of Congress and government officials. In 2020, she re-introduced a bill to ban members of Congress from trading individual stocks.

Warren told Insider that for now, the solution “starts with just enforcement.”

Musk was named Time’s 2021 “Person of the Year” after Musk’s PR people paid off Time editors. At the time, Warren tweeted: “Let’s change the rigged tax code so The Person of the Year will actually pay taxes and stop freeloading off everyone else.”. Democrats including Sen. Sherrod Brown (D-Ohio) and Rep. Pramila Jayapal (D-Wash.) decried the choice of Musk for the Time honor. Both accused the billionaire of not paying his fair share in taxes. “We can’t believe Time Magazine just named Elon Musk its ‘Person of the Year,’” Jayapal said in a statement. “The richest person in the world and yet he avoids paying his taxes while working families struggle to put food on the table and pay rent.”

Musk surpassed Amazon founder Jeff Bezos as the richest man in the world this year. His net worth is over $290 billion.

According to a report released by ProPublica in June, the billionaire paid $68,000 in federal income taxes in 2015, $65,000 in 2017 and no federal income taxes in 2018.

Brown accused Musk of “union-busting” following a 2019 National Labor Relations Board ruling that Tesla acted illegally for firing an employee pushing to unionize.

“A billionaire who has been found guilty of illegal union-busting [National Labor Relations Board] should probably not be @TIME’s Person of the Year,” Brown tweeted.

The back and forth between the businessman and the senator comes the same day that six current and former Tesla employees filed a lawsuit in Alameda County, Calif., alleging sexual harassment in the workplace and after another murder victim was found in Tesla’s factory.

“Bring the charges, pull them out. Make it clear publicly,” she said. “The strongest enforcement is to make known what they are doing and for the voters to retire them forcibly.”

One of the most powerful lawmakers in the U.S. defended the right of congresspeople to trade stocks. She, Feinstein, Reid, Harris and other California politicians own Silicon Valley companies Google, Facebook, Netflix, Apple, Facebook, Tesla, SpaceX and YouTube and get them federal cash. They defund their competitors and put hit-jobs on those competitors, who are their own constituents. These politicians block government actions that would regulate these companies and laws designed to control the corruption and public safety hazards of these companies.

When asked about the issue during a press conference, House Speaker Nancy Pelosi (D-Calif.) said that “We’re a free market economy” and lawmakers “should be able to participate in that.” That reply was an insincere, pandering, smoke-screen of a lie!, as the evidence shows.

Pelosi’s own stock portfolio, which gained over $65 million in value between 2019 and 2021, has often been the subject of scrutiny. The Stop Trading on Congressional Knowledge (STOCK) Act, which was passed in 2012, is designed to combat insider trading by lawmakers, who many across the spectrum argue have too much access to inside information to be able to trade stocks ethically. In October, the Federal Reserve banned its officials from owning individual stocks. In March 2020, four senators were accused of insider trading and investigated by the Justice Department when they sold off stocks ahead of the COVID-19-induced economic downturn.

Voices across the spectrum, especially on the right but also on the left, criticized Pelosi’s comments and questioned her position. Many argue that lawmakers since have access to information that the public does not, and because they also have the ability to write and pass policy, they shouldn’t be allowed to buy and sell individual stocks and other assets. Some on the right highlighted silence from other progressives in response to Pelosi’s statement despite their previous opposition to the practice.

Nancy Pelosi owns more than $500,000 in Apple stock, according to her financial disclosure reports. Pelosi is also the speaker of the House. Congressional Democrats and Republicans alike have introduced multiple antitrust bills that would affect Big Tech companies.

The CEO of Apple, Tim Cook, called Pelosi personally in June and told her not to move ahead on these bills. The House Judiciary Committee passed six of these bills in June. Not one of them has seen movement on the House floor in six months, with some reports pinning the inaction on the speaker.

Back in January, Pelosi’s husband, Paul, bought at least a quarter million in “call” options for Apple, which is a more sophisticated way of betting on a stock going up in value.

Paul Pelosi also bought at least half a million in call options for Tesla, which stood to get subsidized by the Build Back Better bill his wife shepherded through the House.

The Pelosis are already very rich, and nobody but the Pelosis themselves knows the motivations of Nancy Pelosi or the calculations of Paul Pelosi. But still, it ought to raise eyebrows that the speaker of the House keeps taking actions that benefit her stock portfolio.

Yet Pelosi said on Wednesday that there should be no restrictions on her ability to buy and sell stocks in the companies she’s regulating, subsidizing, protecting, and taxing.

Pelosi, says lawmakers/Capitol staff shouldn’t be prohibited from trading stock: “This is a free market, we are a free market economy, they should be able to participate in that.”

— Mariana Alfaro (@marianaa_alfaro) December 15, 2021

This is especially rich because Pelosi has a long history of entangling her policymaking with her family’s profit-making.

Peter Schweizer, in his book Throw Them All Out, documented how Pelosi and her husband have gained insider status and made millions betting on companies that were directly involved in pending legislation.

Back in 2009, I wrote about businessman William Hambrecht, who went into business with Paul Pelosi, hired Paul Jr., and finagled a Financial Services Committee hearing on legislation that would increase business for Hambrecht’s company.

Congressmen and senators and their husbands and wives should be barred from buying and selling stocks, if not owning stocks. At the least, the stocks should be held in a blind trust. Better they should have to divest all their stocks and roll the money into a few select mutual funds.

Maybe we should compensate them for this sacrifice by paying them more, but the people subsidizing, regulating, taxing, exempting, and protecting corporations shouldn’t at the same time be investing in them.

The truth is that no one should trade individual stocks, unless you want to lose your money. Just put what you can in an index fund, and you’ll be fine.

But unlike you, members of Congress are often privy to information the general public doesn’t have, and when they trade on that information, it creates serious conflicts of interest.

Only occasionally is a member of Congress found guilty of that kind of securities fraud; former representative Chris Collins (R-N.Y.) was in 2019. The California Senators sabotaged Zap, Fisker, XP, Apterra and a host of competitors to Tesla because those Senators own Tesla and are financed by Elon Musk. These Senators sabotaged their own constituents in order to profiteer on those Senator’s covert insider trading stock.

When a U.S. senator frantically dumps $1.6 million in stocks just before the market tanks because of the pandemic (and calls his brother-in-law, who immediately dumps his own stocks), people might conclude that their elected representatives must be corrupt.

Fortunately, there’s a simple solution to this problem: Ban members of Congress and staffers from trading individual stocks. For the time they serve in Congress, they can put their holdings into mutual funds.

It isn’t like that’s some kind of hardship unless they are crooks. Over time, the stock market tends to rise! They’ll make money.

A better way to look at this issue might be to ask why it’s important for members of Congress to be allowed to trade individual stocks. Is this some kind of foundational freedom that no American should be denied even for a temporary period? Did generations of brave American service members lay down their lives so your congressman could take a chance on Tesla shares going up next year?

Being a lawmaker is a privilege and a public trust. And it comes with some sacrifices. This doesn’t seem like a particularly onerous one, and it would be easier to enforce than the Stock Act — which doesn’t seem to get much enforcement at all. No complex reporting requirements, no deadlines, and no questions about whether a trade really was based on nonpublic information. Just a simple rule that says that as long as you’re in Congress you can’t buy or sell individual stocks.

The corruption in politics involving stock market payola is MAFIA level crime that the politicians make special laws to exclude themselves from arrest over.

The United States Department of Energy is comprised of two groups of people: One group are the fresh-faced naive college kids, hired on the cheap, often relatives of insiders, who were just plucked out of some Ivy League frat house. They sincerely believe they are working on social justice things and woke energy-for-all schemes. The other group are the old bosses and insiders who own the stock market stocks of each and every company they regulate and fund. The old bosses have all been promised revolving door payola bribe jobs in each and every company they regulate and fund. Old bosses with sign-off authority are friends with the current seated President in the White House, who covertly approves all of the old boss decisions via a web of relay aides. The college kids do vast amounts of work, calculations, studies and reports but everything they do is shoved into a box in storage and ignored if it competes with or reduces the valuation of the venture capital companies that funded the President’s political campaign. So these nerd kids do all this work, that is never actually considered, because the old bosses will never allow anything to get funded or supported that competes with the President’s campaign financiers. The nerd kids are fired, or transferred to the mail room, as soon as they look like they are starting to figure out how the scam works.

For example, Obama and Biden’s political financiers own all of the lithium mines in the world. Toyota and Honda fuel cell cars make those lithium mines obsolete. The kids at DOE found that there is not enough lithium in the world to cover more than a small percentage of the electric cars in the Obama/Biden plan and that almost all the lithium is in countries that will do anything to screw over the U.S. To get that lithium, child slave labor is used and the lithium batteries blow up as they age and the smoke from their fires causes cancer. The U.S. lithium supply inside the U.S. is so minimal that it barely counts. By the time the lithium gets into all the cars, the cars will cost so much, nobody will buy them. Toyota, KIA and Honda fuel cell cars get their hydrogen from water and organic waste, which is endless. World lithium is already running out, but the DOE old bosses are pushing it to make the White House financiers happy. The United States Department of Energy is not a “Department”, it is a political slush-fund!

IF YOU SEE CORRUPTION, REPORT CORRUPTION: WWW.REPORT-CORRUPTION.COM

Post a public web page with all of the details and evidence of the political corruption. Then invite all of the press, public, Inspector General’s, FBI, SEC, FTC and law enforcement to that web page. This will prevent cover-ups and stone-walling and protect you from getting ignored! Never assume that the agencies that are supposed to help you, will help you!

What you can expect to see in the future is a set of material called “THE ENERGY PAPERS“. These materials document an organized-crime using taxpayer dollars to pay quid pro quo to politicians and their tech oligarch financiers. The papers document how bribes, payola and insider deals financed Solyndra, Ener1, Tesla, Abound and others. Elon Musk, Mark Zuckerberg, Eric Schmidt and Larry Page are exposed ordering hit-jobs” on competitors and maintaining covert business ownership’s with U.S. Senators.

There are three groups of people at the FBI, FTC, GAO, OSC, SEC, etc. They are: #1. The Good Guys, #2. The Worker Bees and #3. The Bad Guys, who run cover-ups and protect dirty Senators. We hang out with numbers 1 and 2.

IF YOU SEE CORRUPTION, REPORT CORRUPTION (LINK)

Read THE ENERGY SCAM PAPERS: https://www.the-truth-about-the-dept-of-energy.com/the_energy_scam_papers.pdf

PART ONE: (Download: https://american-corruption.com/wp-content/uploads/abc-tv-plus.mp4 )

Do You Have Tips Or Information About The Tech Cartel’s Illicit Actions?

Send them to all of our contacts at the following addresses, at the same time, to bypass cover-ups:

(1.)

ICIJ @ THE CENTER FOR PUBLIC INTEGRITY

910 17TH STREET NW,

7TH FLOOR,

WASHINGTON, DC 20006, USA

TEL: 202-466-1300;

FAX: 202-466-1101

E-MAIL: contact@icij.org

(2.)

The SEC

The Inspector General

(3.)

Margrethe Vestager, European Union Competition Commissioner

Gunther Oettinger, European Union Commissioner for Digital Economy and Society

Jean-Claude Juncker, European Commission President

European Commission

Rue de la Loi / Wetstraat 200

1049 Brussels

+32 (0) 2 29 62496

(4.)

The FBI

David J. Johnson, Special Agent in Charge, FBI

CC: Peter D. Cair

450 Golden Gate Avenue, 13th Floor

San Francisco, CA 94102-9523

Phone: (415) 553-7400

Fax: (415) 553-7674

E-mail: san.francisco@ic.fbi.gov

(5.)

The Guardian

witness@theguardian.com

(6.)

ACLU

125 Broad Street, 18th Floor,

New York NY 10004

212-549-2500

(7.)

GAO

1 (800) 424-5454 or

e-mail at fraudnet@gao.gov

(8.)

Federal Trade Commission

600 Pennsylvania Avenue, NW

Washington, DC 20580

Telephone: (202) 326-2222

antitrust@ftc.gov

(9.)

The SEC

100 F Street NE

Washington, D.C. 20549-5631.

You may also send a fax to 202-772-9235.

https://www.sec.gov/complaint/tipscomplaint.shtml

(10.)

IRE

141 Neff Annex

Missouri School of Journalism

Columbia, MO 65211

573 882 2042

info@ire.org

(11.)

Cironline

1400 65th St., Suite 200

Emeryville, CA 94608

Phone: 510-809-3160 (main line)

Fax: 510-849-6141

lwilliams@cironline.org

msmith@cironline.org

(12.)

ProPublica

155 Avenue of the Americas

13th Floor

New York, N.Y. 10013

Phone: 1-212-514-5250

Fax: 1-212-785-2634

suggestions@propublica.org

info@propublica.org

INTERNATIONAL LAW ENFORCEMENT OFFICIALS HAVE UNCOVERED THIS ROUTING OF THE PAYMENTS, MONEY LAUNDERING AND TAX EVASION OF THE ATTACKERS HIRED BY THE U.S. POLITICIANS:

An Inconvenient Truth: How Tesla Became a Trillion-Dollar Company Through Corruption, Bribery And Cronyism

Astonishing story about the rise of green technologies using political payola

Elon Musk and his cartel hired attackers to take us out after our products turned out to be safer, lower cost, longer range and better in every way. He couldn’t compete. He chose to cheat rather than compete. We chose to file criminal referrals on him and his cartel with the FBI, SEC, FTC, Congress and Interpol and sue his cronies in Washington, DC and get them fired for corruption…

By Ilya Pestov and The Justice Alliance

After the news that Hertz decided to buy 100 000 Tesla cars for more than $4 billion, Tesla capitalization has already increased almost by $200 billion. I am not talking about the market irrationality anymore, but I feel a bit curious. Hertz has recently emerged from bankruptcy and has not received any wholesale discount from Musk. How and why is Hertz going to buy such expensive cars? The answer is simple — with taxpayers’ money.

Apparently, the White House has recently passed the Budget Reconciliation Bill, which would cost $1.75 trillion for US citizens. There are plenty of benefits for the so-called ‘clean energy’ in it, particularly, 30% of tax deductions for ‘qualified commercial electric vehicles’. It means that after buying Tesla cars Hertz will receive $1.26 billion of tax cashback. In fact, there are also some benefits for the installing of electric vehicle charging stations. Hertz has already announced plans to make thousands of charging stations.

Lithium, Cobalt and rare earth mines are owned by Kleiner Perkins, Goldman Sachs and Department of Energy/White House insiders. That is what power’s Elon Musk’s cars. Many say that Tesla was just a front for invading foreign nations for their lithium batter mines (which are operated with child labor).

It is important to mention that common people have also an access to tax benefits that the public pays for with their April income taxes and the compensation limits are increased from $7500 to $12 500. As an example, instead of paying $15 000 income tax you may buy Tesla Model S and pay just $2500. It is like a pretty bonus from Tesla or a good discount on electric vehicles. Seems to be a good motivation to refuse internal-combustion engines, doesn’t it?

Moreover, Tesla also gets ZEV credits and other benefits for manufacturing its products. That way, the US government restructures the automotive market literally by hand and picks the winners and losers. Do you know what I find the most interesting in this story? The fact that the new bill was published on October, 28th but Hertz announced buying of Tesla cars on October, 25th. As you can understand, the decision was made much earlier.

You may already know that Secretary of Energy Steven Chu, who gave Tesla their money, and his Silicon Valley friends at McKinsey Consulting, who provided the staff for the Department of Energy, were all in the pocket of Kleiner Perkins, where Al Gore works. Chu has now been replaced by an actress named Jennifer, who laughs at any suggestion that her job involves protecting America by keeping gas prices low and who owns the very companies that she is giving government funds to.

Now I would like to tell you about one very interesting character in the US establishment named Al Gore. This is the former US Vice President under Clinton, the presidential candidate in 2000 and the Nobel Peace Prize winner for the film An Inconvenient Truth (2006) about global warming.

His film and book have actually became the foundation for modern climate policy and the public demand for renewable energy sources. One should notice keep in mind that along with the awareness of internal concern for the ecology Al Gore was one of the first who realized the commercial potential in projects devoted to the protection of the environment.

Two years before ‘An Inconvenient Truth’ Al Gore together with Goldman Sachs Chief Asset Manager David Blood has run a new investment company Generation Investment Management. As a result, they both defined terms sustainable investing and ESG.

The former presidential candidate, as we could see, was very good at technology and finance. In 2007, he was suddenly invited to become a partner in Kleiner Perkins — one of the oldest and largest venture funds of Silicone Valley. John Doerr, one of Kleiner Perkins chief partners, joined the advisory board of Generation Investment Management.

J. Doerr, as Al Gore, stood for the innovations in clean energy to struggle with climate change. On the TED conference in 2007, he quoted his daughter “your generation created this problem, you better fix it”. That reminds me on Greta Thunberg’s words which would be told later. So that J. Doerr and Al Gore had a similar vision of the future and the month after mentioned partners’ rotation Kleiner Perkins fund invested into Silver Spring Networks. Biden’s daughter, Ashley, left her hand-written diary for journalists to find where she reveals the same thoughts (in addition to her naked shower play with Joe Biden)

By great coincidence, this deal happened a year before the US Department of Energy had announced a $3.4 billion grant program for smart grid developers. In fact, $560 million of this amount was spent to utilities serviced by Silver Spring Networks, which works exactly with smart grids. 6 years later Silver Spring Networks successfully entered an IPO.

Luck literally pursued Kleiner Perkins. In 2008, the fund invested tens of millions dollars in a start-up hybrid cars manufacturer Fisker Automotive. After that, in September 2009, the company received a low-interest $529 million loan under the Advanced Technology Vehicle Manufacturing (ATVM) direct loan program from the same US Department of Energy.

Congress passed ATVM in 2007 after a drop in sales in the big three (General Motors, Ford, and Chrysler). The volume of the borrowed capital was $25 billion. The goal of the program was to help the US auto industry to reduce fuel costs because Americans were tend to choose more fuel-efficient Japanese cars. That is, the problem devoted not to ecology issues, but much more to fuel saving.

Again, ATVM passed in 2007, but the allocation of funds began only 2 years later on a competitive basis. In February 2009, 8 months before the government loan to Fisker Automotive, John Doerr of Kleiner Perkins became a member of the Presidential Economic Recovery Advisory Council. The funny thing is that Fisker did not even have manufacturing facilities in the USA and the assembly of their Karma models took place in Finland.

The Obama-Biden administration appointed a venture capitalist from Kleiner Perkins as a member of an economic advisory board. They also signed a government loan for help American automotive industry to a company (without any manufacturing capacity in the United States) that Kleiner Perkins has invested in.

That trick was obviously noticed by the public. Some companies have sued the Department of Energy, Mitt Romney even called on Congress to open an investigation into the loan to Fisker Automotive, pointing out that its investors included Al Gore, who sponsored Obama’s presidential campaign. Nevertheless, somehow all those worries dwindled away as federal cover-ups went into full swing.

Fisker’s plans to start the manufacture at a closed GM plant in Delaware at the expense of a government loan, which GM itself did not receive, deserved special attention. These plans caused some questions among local residents, and then current Vice President Joe Biden, who served as Senator from Delaware from 1973 to 2009, assured people that the budget money for Fisker would be paid off, and the company will eventually return “billions-billions” dollars to everyone.

Running ahead, the budget money didn’t return to taxpayers because Fisker went bankrupt in 2013. From the bankruptcy documents, which fell into the journalists’ hands only 7 years later, it turned out that Hunter Biden (Joe Biden’s son) was an investor of Fisker. However, this fact also faded into oblivion without preventing Biden from gaining 58.8% of the votes in Delaware during the 2020 presidential election.

Let us turn back to Tesla. Only $8.4 billion were allocated from the $25 billion program of help to the American auto industry. Only 5 companies received money, although 108 applications were received. Almost $6 billion went to Ford with a democratically oriented management, $1.5 billion were given to Nissan, about half billion — to Fisker and Tesla and, finally, $50 million came to a less known VPG company.

Surprisingly, the credit limit has not been exhausted, large manufacturers like General Motors or Chrysler did not receive money, but two unprofitable startups from California, selling several hundred cars each, did. We already know the main lobbyists of Fisker — they are Al Gore and John Doerr, who invested in Fisker through Kleiner Perkins. But were they acquainted with Elon Musk? A brief search immediately gave a positive answer to that question.

In 2013, Al Gore, while talking about his new Tesla S in an interview to Yahoo Finance, called Elon Musk his friend. More than that, his son Al Gore III has been in charge of Policy & Business Development at Tesla since 2015. After learning that I immediately went to have a look at the Generation Investment Management profile on CB Insights. It turned out that the Gore fund had invested in Musk’s SolarCity in 2011 and Gore III worked there as a Policy Officer.

Then in 2016, Tesla acquired SolarCity. An unprofitable service company that didn’t even produce solar panels was taken over for a suspiciously large amount of money. Recently it turned out that Elon Musk has faced a $9.4 billion fine for this deal, although the final court decision had not been made yet. It is important that after the takeover in 2018, Al Gore became suddenly nominated for the post of chairman of the Tesla board of directors.

Al Gore rejected that offer but I did not doubt more about his close connection with Tesla. At the same time, I was interested in their possible contacts before receiving the lobbied state subsidies of 2009. That’s why I decided to change the angle and check whether Tesla has a relationship with Kleiner Perkins. Then it turned out that Elon Musk had been friends with John Doerr for a very long time.

In 2006, when Tesla looked for money in round С, Kleiner Perkins fund offered $50 million, while VantagePoint offered $70 million. Despite the huge difference in bids, Musk wanted to strike a deal with Kleiner Perkins but on the condition that John Doerr would sit on the board of directors. Unfortunately, J. Doerr had many other obligations and was forced to refuse. That’s why Musk chose VantagePoint, as he told in an interview.

I went on and learned that the vice president of Tesla in 2006–2017 was Diarmuid O’Connell. As I remember, he was responsible for national security issues under former Secretary of State Colin Powell. He also spoke about Iraq chemical weapons and showed test tube to legitimize the military invasion of Iraq at the UN in 2003.

See this video from the internet –

The One Thousand Lies Of Elon Musk:

I wondered how he appeared in that story. However, I didn’t have to look for an answer for a long time, so let us meet Colin Powell, a member of the advisory board of Kleiner Perkins, a strategic partner of the fund in 2005.

There was no direct investment from the fund in the company, nevertheless it seems that there was another strong connection between Kleiner Perkins and Tesla. Is Al Gore really not a government subsidy beneficiary for Tesla? My confirmation bias did not allow this thought to get along in my head. Searching for keywords, I came across publications in Yahoo Finance and Insider Monkey. The articles mentioned Gore’s earlier investment in Tesla.

Keeping in mind that the journalists could simply make a mistake, I began to study which funds were invested in Tesla at earlier stages and whether Al Gore was involved. Finally, I came across an interview with the managing partner of Capricorn Investment Group on the blog of the Japanese financial holding Nomura. He said that Capricorn financed the filming of ‘An Inconvenient Truth’ movie.

Capricorn was founded by Jeffrey Skoll, the former eBay president and billionaire. The fund invested in Tesla together with SpaceX at early stages. Mr Gore brought in $35 million! Can you imagine? “That’s a big wad of cash for someone who reported barely $2 million in assets in 2000, when his job as vice president came to an end”, as the New York Times wrote in 2008.

As a result, Al Gore was the direct beneficiary of providing state loans under the ATVM program for Fisker Automotive and Tesla Motors, in which he owned shares through venture funds Kleiner Perkins and Capricorn Investment Group.

When I proved it, I wanted to learn more about Al Gore’s bio. It has been revealed that after losing the election, in 2001, he became a vice president of Metropolitan West Financial — a company with more than $65 billion in assets under management. The company was managed by former heads of Drexel Burnham Lambert. That was a bankrupt investment bank, which history was very similar to Lehman Brothers.

The same year Mr Gore also joined the Google Advisory Board, in which he invested together with Kleiner Perkins in 1999. Probably that was the time when he met John Doerr. Then, in 2003, the former US presidential candidate became a member of Apple’s board of directors. In addition, the founders of Google were also early investors in Tesla.

It is clear that Albert Gore had many connections in political and financial communities. In 2006, he started a charitable organization The Alliance for Climate Protection. The company launched a $300 million (sic!) ad campaign to mobilize Americans to reduce greenhouse gas emissions immediately. As a result, an “inconvenient truth” was told to everyone.

In 2009, Gore appeared before the United States Senate Committee on Foreign Relations to support Obama’s economic recovery plan. Then the government had passed the Recovery and Reinvestment Act, which included an $80 billion stimulus package to promote green energy initiatives. Newspapers called the bill the “biggest energy bill in history”.

The person who owns stakes in Tesla and Fisker first knocks out government loans and then pushes a law according to which manufacturers of electric vehicles should pay fewer taxes, and buyers of electric vehicles should receive tax deductions. Can you imagine?

Surely, Al Gore was not the only one who acted in this process. In 2006, Nick Pritzker, the brother of Hyatt founder, invested in Tesla. His niece Penny Pritzker became the 38th US Secretary of Commerce in Barack Obama’s cabinet, and his nephew was the Governor of Illinois. In general, Pritzker is one of the richest families in the US.

Among of early investors in Tesla there is Steve Westley, a politician and businessman. He has already joined the company’s board of directors in 2007. More than that, during the 2008 presidential election, Westley acted as a co-chairman of California’s Obama for America campaign. Currently, he is a member of the US Department of Energy advisory board.

Al Gore, John Doerr, Nick Pritzker, Steve Westley, Elon Musk, Sergey Brin, Larry Page — all of them were so-called donors and beneficiaries to the Obama campaign. I mentioned only the names from the public access. Let me remind that these people are only mentioned in the context of the Tesla story while the whole green initiative and the Recovery and Reinvestment Act affects a much larger number of companies and investors.

The rapid development of electric vehicle companies is taking place in a distorted market environment. Their commercial success is mainly driven by government incentives unavailable for ICV cars manufacturers.

The US government is literally restructuring the auto market by hand in order to make one guy: Elon Musk, massively rich.. In that case the active discussions about climate change and greenhouse gas emissions could probably be nothing more than a part of a program to reallocate money in the US establishment since Nancy Pelosi, George Soros and The Feinstein family are the true owners of the stock profits from Elon Musk.

However, the question remains whether this is really a good thing, because there is no full consensus in the scientific community regarding the general belief in the environmental friendliness of electric vehicles and the beneficiaries are always the same 50 people associated with Nancy Pelosi.

————————————————————————————–

Join The ANTI-CORRUPTION PARTY That Is Ending This Kind Of Political Corruption

Join millions of citizens that are working on ending this political corruption, cronyism, black-listing and insider trading by public officials.

WE, THE PEOPLE are solving this problem. Democrats, Republicans, Libertarians, Green Party Advocates and ALL other party member are working with us to end these social crimes.

The Process:

LAWS YOU NEED TO FORCE YOUR POLITICAL REPRESENTATIVES TO MAKE

These are the steps that the you, The Public, must demand to strengthen public integrity by eliminating corrupt financial conflicts in Congress.

Congress must be ordered to eliminate both the appearance and the potential for financial conflicts of interest. Americans must be confident that actions taken by public officials are intended to serve the public, and not those officials. These actions counter-act the actions taken by Administration staff and Department of Energy officials in illicit coordination with U.S. Senators.

We experienced all of the damages from each of the abuse-of-power issues listed below. Your public officials are being paid BRIBES through their family stock market holdings.

CUT THEM OFF – Demand that Congress make it a felony for any politician, judge or regulator to own stocks, or to let their family own stocks. If they want to get rich, they can go into another line of work.

If you can get these laws made, it will end 90% of American corruption. Politicians won’t allow these laws to be made because it will cut off their corruption. Thus: You have to force the politicians to make these laws and leverage them with investigations and recall elections.

These are the actions needed to resolve this corruption:

- Ban individual stock ownership by Members of Congress, Cabinet Secretaries, senior congressional staff, federal judges, White House staff and other senior agency officials while in office. Prohibit all government officials from holding or trading stock where its value might be influenced by their agency, department, or actions.

- Apply conflict of interest laws to the President and Vice President through the Presidential Conflicts of Interest Act, which would require the President and the Vice President to place conflicted assets, including businesses, into a blind trust to be sold off

- Require senior Department of Energy government officials, employees, contractors and White House staff to divest from privately-owned assets that could present conflicts, including large companies like Tesla, Google, Facebook, Sony, Netflix, etc., and commercial real estate.

- Make it a felony to not respond to a filing by a citizen within 48 hours. Former White House and Energy Department staff use ‘stone-walling’ to intentionally delay responses for a decade, or more.

- Apply ethics rules to all government employees, including unpaid White House staff and advisors.

- Require most executive branch employees to recuse from all issues that might financially benefit themselves or a previous employer or client from the preceding 4 years.

- Create conflict-free investment opportunities for federal officials with new investment accounts managed by the Federal Retirement Thrift Investment Board and conflict-free mutual funds.

- Close and lock the Revolving Door between industry and government and stop tech companies from buying influence in the government or profiting off of the public service of any official.

- Lifetime ban on lobbying by Presidents, Vice Presidents, Members of Congress, federal judges, and Cabinet Secretaries; and, multi-year bans on all other federal employees from lobbying their former office, department, House of Congress, or agency after they leave government service until the end of the Administration, but at least for 2 years ( and at least 6 years for corporate lobbyists).

- Limit the ability of companies to buy influence through former government officials.

- Require income disclosures from former senior officials 4 years after federal employment.

- Prohibit companies from immediately hiring or paying any senior government official from an agency, department, or Congressional office recently lobbied by that company.

- Prohibit the world’s largest companies, banks, and monopolies (measured by annual revenue or market capitalization) from hiring or paying any former senior government official for 4 years after they leave government service.

- Limit the ability of companies to buy influence through current government employees.

- Prohibit current lobbyists from taking government jobs for 2 years after lobbying; 6 years for corporate lobbyists. Public, written waivers where such hiring is in the national interest are allowed for non-corporate lobbyists only.

- Prohibit corporate outlaws like Google, Tesla, Facebook, Linkedin, Netflix, Sony, etc., from working in government by banning the hiring of top corporate leaders whose companies were caught breaking federal law in the last 6 years.

- Prohibit contractor corruption by blocking federal contractor and licensee employees from working at the agency awarding the contract or license for 4 years.

- Ban “Golden Parachutes” that provide corporate bonuses to executives for federal service.

- Publicly expose all influence-peddling in Washington.

- Strengthen and expand the federal definition of a “lobbyist” to include all individuals paid to influence government.

- Create a new “corporate lobbyist” definition to identify individuals paid to influence government on behalf of for- profit entities and their front-groups.

- Radically expand disclosure of lobbyist activities and influence campaigns by requiring all lobbyists to disclose any specific bills, policies, and government actions they attempt to influence; any meetings with public officials; and any documents they provide to those officials.

- End Influence-Peddling by Foreign Actors such as that which occurred in the ENER1, Severstal, Solyndra and related scandals.

- Fire the Fed officials that own, trade and pump stocks using the Fed itself for profiteering.

- The most senior officials in the U.S. Government are the worshipers of Elon Musk, investor’s in Elon Musk’s companies and suppliers, deciders of the financing for Elon Musk, suppliers of staffing to Elon Musk, recipients of political campaign financing by Elon Musk and Musk’s covert Google And Facebook partnership, social friends of Elon Musk and the attackers of Elon Musk’s competitors. Make this a felony.

- Combat foreign influence in Washington by banning all foreign lobbying.

- End foreign lobbying by Americans by banning American lobbyists from accepting money from foreign governments, foreign individuals, and foreign companies to influence United States public policy.

- Prohibit current lobbyists from taking government jobs for 2 years after lobbying; 6 years for corporate lobbyists. Public, written waivers where such hiring is in the national interest are allowed for non-corporate lobbyists only.

- End Legalized Lobbyist Bribery and stop lobbyists from trading money for government favors.

- Ban direct political donations from lobbyists to candidates or Members of Congress.

- End lobbyist contingency fees that allow lobbyists to be paid for a guaranteed policy outcome.

- End lobbyist gifts to the executive and legislative branch officials they lobby.

- Strengthen Congressional independence from lobbyists and end Washington’s dependence on

lobbyists for “expertise” and information. - Make congressional service sustainable by transitioning Congressional staff to competitive salaries that track other federal employees.

- Reinstate the nonpartisan Congressional Office of Technology Assessment to provide critical scientific and technological support to Members of Congress.

- Level the playing field between corporate lobbyists and government by taxing excessive lobbying beginning at $500,000 in annual lobbying expenditures, and use the proceeds to help finance Congressional mandated rule-making, fund the National Public Advocate, and finance Congressional support agencies.

- De-politicize the rulemaking process and increase transparency of industry efforts to influence federal agencies.

- Require individuals and corporations to disclose funding or editorial conflicts of interest in research submitted to agencies that is not publicly available in peer-reviewed publications.

- Prevent McKinsey-type sham research from undermining the public interest by requiring that studies that present conflicts of interest to undergo independent peer review to be considered in the rule-making process.

- Require agencies to justify withdrawn public interest rules via public, written explanations.

- Close loopholes exploited by powerful corporations like Google, Facebook, Tesla, Netflix, Sony, etc., to block public interest actions.

- Eliminate loopholes that allow corporations, like Tesla and Google, to tilt the rules in their favor and against the public interest.

- Restrict negotiated rule-making to stop industry from delaying or dominating the rule-making process by ending the practice of inviting industry to negotiate rules they have to follow.

- Restrict inter-agency review as a tool for corporate abuse by banning informal review, establishing a maximum 45-day review period, and blocking closed -door industry lobbying at the White House’s Office of Information and Regulatory Affairs.

- Limit abusive injunctions from rogue judges, like Jackson, et al, by ensuring that only Appeals Courts, not individual District Court judges , can temporarily block agencies from implementing final rules.

- Prevent hostile agencies from sham delays of implementation and enforcement by using the presence of litigation to postpone the implementation of final rules.

- Empower the public to police agencies for corporate capture.

- Increase the ability of the public to make sure their interests are considered when agencies act.

- Create a new Office of the Public Advocate empowered to assist the public in meaningfully engaging in the rule-making process across the federal government.

- Encourage enforcement by allowing private lawsuits from members of the public to hold agencies accountable for failing to complete rules or enforce the law, and to hold corporations accountable for breaking the rules.

- Inoculate government agencies against corporate capture such as Google undertook against the White House.

- Provide agencies with the tools and resources to implement strong rules that reflect the will of Congress and protect the public.

- Boost agency resources to level the playing field between corporate lobbyists and federal agencies by using the proceeds of the tax on excessive lobbying and the anti-corruption penalty fees to help finance Congress-mandated rule-making and facilitate decisions by agencies that are buried in an avalanche of lobbyist activity.

- Reform judicial review to prevent corporations from gaming the courts by requiring courts to presumptively defer to agency interpretations of laws and prohibiting courts from considering sham McKinsey studies and research excluded by agencies from the rule-making process.

- Reverse the Congressional Review Act provision banning related rules that prevent agencies from implementing the will of Congress based on Congress’ prior disapproval of a different, narrow rule on a similar topic.

- Improve judicial integrity and defend access to justice for all Americans.

- Strengthen Judicial Ethics Requirements.

- Enhance the integrity of the judicial branch by strengthening rules that prevent conflicts of interest.

- Ban individual stock ownership by federal judges.

- Expand rules prohibiting judges from accepting gifts or payments to attend private seminars from private individuals and corporations.

- Require ethical behavior by the Supreme Court by directing the Court to follow the Code of Conduct that binds all other federal judges.

- Boost the transparency of Federal Courts.

- Enhance public insight into the judicial process by increasing information about the process and reducing barriers to accessing information.

- Increase disclosure of non-judicial activity by federal judges by requiring the Judicial Conference to publicly post judges’ financial reports, recusal decisions, and speeches.

- Enhance public access to court activity by mandating that federal appellate courts live-stream, on the web, audio of their proceedings, making case information easily-accessible to the public free of charge, and requiring federal courts to share case assignment data in bulk.

- Eliminate barriers that restrict access to justice to all but the wealthiest individuals and companies.

- Reduce barriers that prevent individuals from having their case heard in court by restoring pleading standards that make it easier for individuals and businesses that have been harmed to make their case before a judge.

- Encourage diversity on the Federal Bench.

- Strengthen the integrity of the judicial branch by increasing the focus on personal and professional diversity of the federal bench.

- Create a single, new, and independent agency dedicated to enforcing federal ethics and anti-corruption laws.

- Support stronger ethics and public integrity laws with stronger enforcement.

- Establish the new, independent U.S. Office of Public Integrity, which will strengthen federal ethics enforcement with new investigative and disciplinary powers.

- Investigate potential violations by any individual or entity, including individuals and companies with new subpoena authority.

- Enforce the nation’s ethics laws by ordering corrective action, levying civil and administrative penalties, and referring egregious violations to the Justice Department for criminal arrest and enforcement.

- Receive and investigate ethics complaints from members of the public.

- Absorb the U.S. Office of Government Ethics as a new Government Ethics Division tasked with providing confidential advice to federal employees seeking ethics guidance.

- Consolidate anti-corruption and public integrity oversight over federal officials, including oversight of all agency Inspectors General, all ethics matters for White House staff and agency heads, and all waivers and recusals by senior government officials.

- Remain independent and protected from partisan politics through a single Director operating under strict selection, appointment, and removal criteria.

- Provide easy online access to key government ethics and transparency documents, including financial disclosures; lobbyist registrations; lobbyist disclosures of meetings and materials; and all ethics records, recusals, and waivers.

- Maintain a new government-wide Office of the Public Advocate, which would advocate for the public interest in executive branch rule-making.

- Enforce federal open records and FOIA requirements by maintaining the central FOIA website and working with the National Archives to require agencies to comply with FOIA.

- Strengthen legislative branch enforcement.

- Expand an independent and empowered ethics office insulated from congressional politics.

- Expand and empower the U.S. Office of Congressional Ethics, which will enforce the nation’s ethics laws in the Congress and the entire Legislative Branch, including the U.S. Senate.

- Conduct investigations of potential violations of ethics laws and rules by Members of Congress and staff with new subpoena power.

- Refer criminal and civil violations to the Justice Department, the Office of Public Integrity, or other relevant state or federal law enforcement.

- Recommend disciplinary and corrective action to the House and Senate Ethics Committees.

- Boost transparency in government and fix Federal Open Records laws, public official and candidate tax disclosure.

- Disclose basic tax return information for candidates for federal elected office and current elected officials.

- Require the IRS to release tax returns for Presidential and Vice-Presidential candidates from the previous 8 years and during each year in federal elected office.

- Require the IRS to release t ax returns for Congressional candidates from the previous 2 years and during each year in federal elected office.

- Require the IRS to release tax returns and other financial information of businesses owned by senior federal officials and candidates for federal office.

- Require the IRS to release tax filings for nonprofit organizations run by candidates for federal office.

- Disclose the Cash behind Washington Advocacy and Lobbying.

- Prevent special interests from using secret donations from corporations and billionaires to influence public policy without disclosure.

- Require nonprofit organizations to list donors who bankrolled the production of any specific rule-making comment, congressional testimony, or lobbying material, and to reveal whether the donors reviewed or edited the document.

- Require individuals and corporations to disclose funding or editorial conflicts of interest in research submitted to agencies that is not publicly available in peer-reviewed publications.

- Prevent sham research, like that from DNC shill McKinsey Consulting, from undermining the public interest by requiring that studies that present conflicts of interest to independent peer review to be considered in the rule-making process.

- Improve the Freedom of Information Act (FOIA).

- Close the loopholes in our open records laws that allow federal officials to hide tech industry and Silicon Valley oligarch industry influence.

- Codify the default presumption of disclosure and affirmatively disclose records of public interest, including meeting agendas; government contracts; salaries; staff diversity; and reports to Congress.

- Require all agencies to use a central FOIA website that is searchable and has downloadable open records databases with all open FOIA requests and all records disclosed through FOIA.

- Strengthen FOIA enforcement by limiting FOIA exemptions and loopholes, and by giving the National Archives the authority to overrule agency FOIA decisions and to compel disclosure.

- Extend FOIA to private-sector federal contractors, including private federal prisons and immigration detention centers, and require large federal contractors to disclose political spending.

- Make Congress more transparent by ending the corporate lobbyists leg up in the legislative process. The public deserves to know what Congress is up to and how lobbyists influence legislation.

- Require all congressional committees to immediately post online more information, including hearings and markup schedules, bill or amendments text, testimonies, documents entered into the hearing record, hearing transcripts, written witness answers, and hearing audio and video recordings.

- Require Members of Congress to post a link to their searchable voting record on their official websites.

- Require lobbyists to disclose when they lobby a specific congressional office; specific topics of visit; the official action being requested; and all documents provided to the office during the visit.

Do these seem like common-sense rules that should have already been in place? They are!

These anti-corruption rules have been blocked by your own elected officials because they work for themselves and not you!

You need to PUNISH any public official who does not put these changes into effect!

We are not asking for your money or your mailing list data. First: Simply put the logo at the top of his page (download it here) on all of your blogs, websites, social media, T-shirts and other visible locations. Next: only vote for candidates who promise to enact the platform goals, above, and stop any candidates who do not promise, in writing, to enact these goals.

That’s it. It is that easy!

If you want to support us, then promote this website link and copy-paste the text on it around the globe. You don’t need to give us your money. Spend it on media and marketing promotions of this site and the text on it. You can use www.newswire.com, Mohr Publicity, promoteyourwebsite.com, and many other services, to make the message global.

News And Reports:

Report: Over 131 Federal Judges Broke The Law by Hearing Cases Where They Had A Financial Interest

WHO IS HELPING US “END POLITICAL CORRUPTION IN AMERICA”?

TAKE A LOOK AND OUR PEERS. BECOME PART OF THE TEAMS…

1/3 of each federal intelligence agency and law enforcement agency are “Elliot Ness” class “good guys”. Some of them are helping us. Everyone knows that there are crooks that work at government agencies that run cover-ups and stonewall in order to protect crooked Senators. We don’t deal with the “bad guys” at those agencies, we turn them in to the IG. If you hunt around, and pull dossiers (from other agencies) on each government worker you might be talking with, you can find the good ones. Half of Congress helps with this goal, from Democrat Elizabeth Warren to Republican Devin Nunes. Over 1000 community service groups help with this goal including:

- http://www.majestic111.com

- http://american-corruption.com/public

- http://vcracket.weebly.com

- https://www.transparency.org

- https://www.judicialwatch.org

- https://wikileaks.org

- https://causeofaction.org

- https://fusion4freedom.com/about-gcf/

- http://peterschweizer.com/

- http://globalinitiative.net

- https://fusion4freedom.com/the-green-corruption-files-archive/

- https://propublica.org

- https://www.allsides.com/unbiased-balanced-news

- http://wearethenewmedia.com

- http://ec.europa.eu/anti_fraud/index_en.html

- http://gopacnetwork.org/

- http://www.iaaca.org/News/

- http://www.interpol.int/Crime-areas/Corruption/Corruption

- http://www.icac.nsw.gov.au/

- http://www.traceinternational.org/

- http://www.oge.gov/

- https://ogc.commerce.gov/

- https://anticorruptionact.org/

- http://www.anticorruptionintl.org/

- https://represent.us/

- http://www.giaccentre.org/dealing_with_corruption.php

- http://www.acfe.com/

- https://www.oas.org/juridico/english/FightCur.html

- https://www.opus.com/international-anti-corruption-day-businesses/

- https://www.opengovpartnership.org/theme/anti-corruption

- https://www.ethicalsystems.org/content/corruption

- http://www.report-corruption.com

- https://sunlightfoundation.com/

- http://www.googletransparencyproject.org/

- http://xyzcase.weebly.com

- https://en.wikipedia.org/wiki/Angelgate

- https://www.opensecrets.org/

- https://en.wikipedia.org/wiki/High-Tech_Employee_Antitrust_Litigation

- http://www.projectveritasaction.com

…and tens of thousands of investigative reporters…

…and millions of members of the public that have learned how to engage in crowd-sourced digital forensics with only their notebook computers and some free database software…

Over 12 Tesla Whistle-Blowers had mysterious deaths

Over 12 Tesla Whistle-Blowers had mysterious deaths

Here is one of the hired attackers that were bankrupted, put out of business and had all of their staff placed under life-long surveillance:

Scott_Douglas_Redmond__Inside_the_Delightful_Death_of_Gawker_