Additional Tesla Articles and Research Documents…

LINK TO THIS PAGE: http://wp.me/P4e1uX-21n

What are the things the media has said that Tesla did? PART 1

What are the things the media has said that Tesla did? PART 1

* They bribed White House staff in order to get nearly free taxpayer funding.

* The investors for Tesla paid McKinsey Consulting to write manipulated white papers, for the White House, saying that Tesla was the way to go and then they got McKinsey to staff the Dept. of Energy with their investor’s friends, from McKinsey, so that they would make sure they favored the schemed-up deal through the process. ie: Matt Rogers, etc.

* White House Staff: Gibbs, Rattner, Emanual, Axelrod et al,: All took off from the White House at nearly the same time for fear of getting caught, knew about this.

* DOE staffers: Lachlan Seward and Matt Rogers were ordered, by Tesla investors, to destroy documents at DOE that documented the Tesla transaction.

* The Section 136 law and Federal Procedural Protocol stated that applicants would be reviewed in the order they applied. DOE issued 42 documents stating that applicants would be reviewed and processed in the order they applied. Suddenly, in March of the application process, year, Matt Rogers & Lachlan Seward ordered a DOE press releases sent out which changed the law (illegally) to remove the first-come-first-served requirement in order to attempt to allow them to move Fisker and Tesla to the front of the line. This was done on orders from Tesla’s investors at Kleiner.

* People who already have Tesla cars say the battery packs overheat and the cockpit gets too hot and the car is noisy as all get out.

* When Tesla applied to DOE, they were hand-walked through the process by DOE staff when no other applicants got the same “personal valet service” treatment. This fact helps prove bribery and collusion. Many, many other facts prove this too.

* In a meeting with one of the law firms Tesla hired to leverage the loan, the law firm said: “don’t worry, we control 14 agencies in DC!” That firm paid themselves millions of dollars for a small amount of work.

* When Tesla applied to DOE, they had no actual engineering or factory plans done for the car and showed fake plans, none of which have been used in the factory that exists today. They said they were going to build a factory in San Jose, California when they knew they did not even need one but Goldman Sachs had said they could get “all the money they wanted because the deal was rigged for favors” so “just go for it”.

* Tesla has announced a number of “showcase” famous people hires but once those people did get hired and started working at Tesla, they saw what a rigged company it was, and quit or suddenly “left to pursue other interests”

* Two well known Tesla staff were starting to whistle-blow about Tesla but they were killed in a plane crash right next to Tesla’s offices. Their notes have been distributed to the media, though, by their co-workers.

* Tesla got thousands of order requests from Tesla nvestors and their business friends at Stanford in order to prop up the appearance of orders but, in reality, not so much!

* Tesla investors ordered Chu to rig the tests done by Argonne labs about Tesla to make the results look better than they were.

* Tesla changed the prices on customers AFTER they had left deposits. This is extremely unethical.

* Tesla’s books showed that they have wasted over $40M on “expenses of no value or engineering that had to entirely thrown away”.

* Tesla’s CEO bugged his own employees because of his extreme paranoid personality.

* An ex-co-founder has a copy of the CEO’s hard drive.

* Tesla’s CEO paid the producers of Iron Man to refer to him in the movie in order to manifest his delusional image of himself. He paid 60 minutes to do a story about him.

* Kleiner Perkins put Steven Chu in office by manipulating campaign funding so that Chu could make sure Fisker & Tesla got their funding so the kick-backs would come around into the 360 deal that was set-up. Kleiner staff hid contributions via law firms but “bundled” millions of dollars of contributions and received over $1B in profit options.

* The number of people Tesla said they were going to hire at the NUMMI plant and the number of people that are hired are not quite what we expected. If you look at the cost to the taxpayer per new job created by Tesla you could have paid the mortgage for some taxpayers homes for what it cost the taxpayer per new job at Tesla after they got the DOE money.

* A man named Marty invented the Tesla, Elon Musk took it away from him so Kleiner could use it as an industry manipulation bull dozer.

* They bribed DOE staff in order to get nearly free taxpayer funding by bundling campaign funds via third parties and PAC’s.

* 16 Tesla investor law firms, most with primary offices in Washington, DC managed the hiding, conduiting, bundling and re-cloaking of the money movements in this whole scam guided by staff from Goldman Sachs.

* They took our money and built multiple bragging cars for rich middle-age-crisis males that no family can afford nor that have any value for the average American. There is nothing novel or special about either Tesla car.

* The CEO screwed his ex wife over, his co-founders over and the public over. He paid millions to shut them up but her never paid their friends to shut up so, it is all going to come out now.

* You can buy an electric car that does much more than a Tesla for many, many, many times less money. There is no need for Tesla.

* Foreigners from the middle east own parts of Tesla.

* Tesla staff bribed DOE reviewers to give Tesla good fake reviews in the loan due diligence, when, in fact, in a public side-by-side comparison, Tesla would have failed miserably against all other applicants.

* The amount of money Tesla needs to make compared to the amount of money Tesla has had invested in it compared to the other companies selling electric cars compared to the world car market shows numbers that clearly show today, and at the time of application to DOE, that Tesla had the worst financial upside metrics of any car company in the world. SO why did they get the Loan?

* The Tesla investors worked with Goldman Sachs and LIBOR rigging of loans to get the finders and intermediaries sweetheart fees.

* Intermediaries and “finders” who were friends of the CEO, took huge amounts of public dollars as ” upfront fees” and ran.

* Senators and their husband’s business ownerships got favors from the associated real estate deals from the NUMMI plant for Tesla.

* Tesla took our tax money yet posted numerous job openings on Linkedin, and other sites, to hire “Immigration Paralegals” to hire H-1B foreigners to work for them.

* Tesla is run by the 1% for the 1%.

* Steve Westly is the bundler who threatened Washington officials with campaign fund cut-offs if they did not give his company: Tesla, a nearly free loan.

* Tesla manipulated their books when they applied for the loan in order to look like they met the DOE requirements but a true forensic examination of their books from that time shows that they did not meet the requirements.

* The CEO lied to the City of San Jose about building a factory there.

* The CEO of Tesla has been sued by his ex wife for cheating on his wife and children with loose women.

* It is a Ponzi scheme of a company.

* The CEO has been sued by his Tesla co-founders for engaging in civil criminality. Those co-founders and Tesla staff provided almost all of the data in this website.

* The CEO paid GQ magazine to write an article about how wonderful girls should think he is so he could get more silicon valley hook-ups.

* The two models of the cars have had multiple EMF meters placed in them at different states of operation and been found to have enough EMF to cause cancer. The cars were measured with isotropic broadband EMF meters, Agilent Technologies portable spectrum analyzers, Aaronia calibrated broadband antenna’s and spectrum sweeping multiplex antennas while charging and driving at increments of 20 MPH up to 110MPH. Drivers have reported experiencing sleep problems, heart problems, depression, migraines, seizures, and changes in neurological chemistry. Thousands of peer reviewed scientific papers prove that these EMF ranges do cause these health issues as well as triggering cancer cell growth per cell. Tesla engineers advised that the car should be shielded but Tesla executives said it wasn’t worth the cost and that nobody would find out.

* Steve Spinner, was put in the DOE by McKinsey under orders from Kleiner. He was a liaison for Solyndra, his wife worked for Solyndra, and he was an “early warning system” watchdog for Tesla at DOE and notified Tesla if anybody not in the ” inside group” came snooping around at DOE.

* They were so screwed up in planning to build the car that they were over $100,000.00 IN ERROR, on the cost per car. With engineering this bad, they still got their federal loan and this shows that bribes took place.

* If law enforcement interviews all past and current Tesla staff and investors, they will find multiple validation evidence for every statement on this site.

* The CEO stays up at night writing different fake emails to each of his employees with a few words different in each email to see which employees might be spying on him. Many Tesla staff collect these spy emails as a hobby.

* The CEO has stated that he hates unions and wants to come up with as many robots as possible to AVOID using people in jobs.

More coming….

(These, and more, charges are documented in many third party reports, articles, studies and investigations)

One of Tesla’s many ads to help hire foreigners using taxpayer $$:

One of Tesla’s many ads to help hire foreigners using taxpayer $$:

Posted On LinkedIn:

Senior Immigration Paralegal – Tesla Motors- Palo Alto, California (San Francisco Bay Area)

Job Description

Brief Description

The Senior Immigration Paralegal would be Tesla’s first in-house immigration legal resource and would therefore be responsible for helping Tesla to build-out its immigration law support program. This position manages, oversees and directly assists in handling a large portion of immigration matters in-house, specifically employment-based, nonimmigrant visa applications and permanent residency applications. This position is also responsible for compiling and maintaining various status reports and records relative to immigration related expenses.

Responsibilities:

•Start to finish preparation of employment-based immigration petitions with minimal assistance and supervision from outside immigration counsel, including: •J-1 visas;

•H-1B visas;

•I-140 visas; and

•Various other visas.

•Regularly provide instruction and advice to Tesla employees and foreign nationals on immigration practices and procedures.

•Assist with any problems that may arise relative to a foreign national’s immigration status.

•Assist in the preparation of a monthly status report by tracking immigration costs, volume of immigration files and location of immigration files.

•Create and regularly maintain the legal department’s customized software report to track ongoing immigration matters at all Tesla entities with immigration needs.

•Work with Human Resources to ensure immigration files remain in compliance with state and federal government agency regulations.

•Ensure employee and employer compliance with Tesla’s new immigration policy and procedures.

•Directly handle the recruitment steps necessary to sponsor a foreign national employee for permanent residency.

•Assist with U.S. national’s work-related emigration to foreign countries.

Desired Skills & Experience

Qualifications/Requirements:

•Strong, in-depth knowledge of immigration law, including experience with each visa type mentioned above.

•8-10 years of Immigration Paralegal experience preferred.

•Bachelor’s degree preferred with a strong academic background.

•Strong legal writing and drafting skills.

•Accuracy and attention to detail is a must.

•Experienced professional with great relationship skills, team player, self starter, independent thinker, and has the ability to anticipate the next steps and future issues.

•Ability to work well in a diverse and fast-paced environment with a large and diverse group of people, including Human Resources, Global Mobility, Tesla recruiting, Tesla hiring managers, candidates from countries throughout the world as well as their families.

Additional Information

Posted:August 9, 2011Type: Full-time Experience: Mid-Senior level Functions: Legal Industries: Automotive Job ID:1845406

Eric Holder to bring the hammer down on Tesla! Will nail companies who “confronted a public safety emergency as if it was simply a public relations problem”

In his speech today, Eric Holder stated that DOJ is bringing the pain to all car companies who “….intentionally concealed information and misled the public about safety issues,” Holder said at a news conference in Washington, adding: “Rather than promptly disclosing and correcting safety issues about which they were aware,

“….made misleading public statements to consumers and gave inaccurate facts to members of Congress.”

The Justice Department stated that it is now willing to aggressively pursue automakers under a 2000 law giving it the power to prosecute those who mislead federal regulators about safety problems. Holder said he hopes the case serves as a warning for other automakers (like Tesla).

“The announcement that I am making today, I think, is reflective of the aggressive nature we will take in looking at these kinds of charges,” he said. “I think this is a sign for the industry that we take these matters seriously and that individuals and corporations will be held accountable.”

“Put simply, …conduct was shameful. It showed a blatant disregard for systems and laws designed to look after the safety of consumers.” said Holder

Senate Commerce Committee Chairman Jay Rockefeller (D-W.Va.) praised the deal.

“The Justice Department’s settlement with Toyota should put all automakers on notice: There is absolutely no excuse for misleading the public or concealing information from the National Highway Traffic Safety Administration,” Rockefeller said in a statement. “Lives are at risk when this happens. Safety must always be the first priority for manufacturers, regardless of how it affects profit margins.”

The head of the NHTSA, Strickland, recently quit after being confronted with charges he protected Tesla by overlooking bad safety reports.

Tesla has been accused of lying to Congress and the NHTSA.

D-Denver P

————————————

SEE TESLA INVESTIGATIONS HERE>>>

———————————-

A close associate from Covington & Burling LLP, the law firm and lobby group that placed Eric Holder in office, said: “he is the right guy to do this job”.

9 questions for Tesla’s Elon Musk

By Alex Taylor III, senior editor-at-large

elon musk

(Fortune)

At about $90,000 apiece, Tesla’s zero emission cars have become a symbol for those in the moneyed class who want to show a commitment to the environment. At the same time, billionaire CEO Elon Musk has emerged as the company’s chief spokesman and cheerleader, encouraging optimistic sales projections and batting away doubters and naysayers who say the company’s shares are overpriced and the cars are overrated. In recent weeks, he’s battled both the New York Times and Barron’s over what he perceived to be negative coverage about the company’s prospects. “I have no interest in an article that debates what we consider to be an obvious point — which is that there is a dramatic reduction in battery costs,” Musk told the Barron’s reporter. “You clearly do not understand the business.” Then he terminated the interview.

Is Musk the next Henry Ford — or Preston Tucker? By getting Tesla (TSLA) into production with a saleable car designed from the ground up, he’s already gone further in the auto business than many people expected (see Henrik Fisker), but Tesla’s stratospheric rise has generated heated debate on websites like Seeking Alpha and Motley Fool as to whether it can continue to expand at its current rate. Here are nine questions for Tesla and Musk:

1. Is Tesla’s stock price the result of irrational exuberance?

As numerous commentators have pointed out, your company’s finances look more like an Internet startup’s in 1999 than those of a traditional automaker. Tesla has made money in only one quarter during its 10-year history, is expected to only break even this year, and make a buck a share in 2014. That works out to a forward p/e of roughly 100.

Tesla could possibly make 35,000 vehicles per year by 2015, but GM (GM, Fortune 500) and Ford (F, Fortune 500) respectively produced 252,894 and 246,585 vehicles during the month of May in the U.S. alone. GM has a trailing p/e of 11.9 and Ford 10.7. Investors have to decide where the best value lies.

2. Can you make money selling cars without air pollution credits?

Behind Tesla’s $11 million first-quarter profit, analysts figure there is nearly $100 million in one-time or otherwise unsustainable items, including $68 million in zero emission credits that you’ve said will disappear by the end of the year. That will leave a big hole in your operating statement. How will you be able to fill it?

3. AutoData reports that Tesla sales declined 14.7% in May. Is this a one-month blip or a sign that the immediate demand by early adopters has been satisfied?

Part of the auto business is fashion; cars with flashy designs or novel concepts get a big initial boost but have a faster decay in their sales curve than more conventional cars with steadier demand. Teslas are high fashion: eye-catching designs combined with unusual powertrains. The sales slump could also be a sign that your company is exhausting the market for super-premium priced cars. The number of people shopping for Porsches and higher-priced Mercedes and BMWs is thin and essentially finite, and Tesla may have already gotten its share. It is also worrisome that you used to brag about your order backlog, but now you won’t release that information any longer. What is going on?

Elon Musk: Electric car competition is key

Elon Musk: Electric car competition is key

4. Can you continue to roll out your distribution model nationwide, given the opposition of local dealers and the barriers of state franchise laws?

Instead of using franchised dealers, Tesla is distributing its cars through company-owned outlets. You argue, reasonably, that “existing franchise dealers have a fundamental conflict of interest between selling gasoline cars, which constitute the vast majority of their business, and selling the new technology of electric cars.” But that puts you in opposition to state franchise laws enacted in the 1920s to protect independent dealers. Tesla has won court decisions in Massachusetts and New York but suffered setbacks in Virginia and Texas. Advocates of the franchise system argue that independent dealers are essential to provide inventory buffers and to interface directly with customers.

5. Does it really make sense to build a nationwide recharging network?

Since electric cars have limited ranges, everyone agrees that a network of charging stations is essential to their widespread adoption. Supercharger stations can return most of a vehicle’s range in 25 minutes but cost $150,000 apiece. You currently operate eight supercharger stations, including six in California, one in Connecticut, and one in Delaware, and you have promised to install 200 coast-to-coast by the end of 2014. Won’t the supercharger attendant in Nevada or Kansas be as lonely as the Maytag repairman?

6. Is guaranteeing the residual value a smart business decision?

In May, you announced that you will guarantee to anyone who leases a Tesla that it will have a higher residual value after three years than any other luxury car on the market. That’s nice, but who knows what a Tesla will be worth three years from now? As analysts have pointed out, that just shifts the risk from car owners to shareholders. You could be stuck with a lot of vehicles that are worth less than expected

7. Can you bring down the price of batteries far enough to build a $40,000 car?

You have said you will launch a small electric sedan in late 2016 with a range of at least 200 miles and a price point “half” that of the flagship Model S. That means it will start at about the same price as the Nissan Leaf — around $30,000 — but have triple the range. You said you were “pretty optimistic” that the necessary advances in battery technology are achievable without “any miracles happening.” There aren’t many who are equally optimistic.

8. Every other EV manufacturer is struggling. Are you really that much better?

GM just cut the price of the 2013 Chevrolet Volt by $4,000 to boost stalling sales. Nissan sold only 2,138 Leafs in May. The only electric car that has been made so far that could compete with the Model S was the Fisker Karma, which looked attractive, was powerful, and had a high range. Unfortunately, the Karma was not a success, and Fisker is now defunct.

9. Are you in danger of overreaching?

Google (GOOG, Fortune 500) founders Larry Page and Sergey Brin were both investors in Tesla before its 2010 initial public offering, and that’s pretty intoxicating company. So perhaps we shouldn’t be surprised that you are talking with Google about adding driverless technology to your cars. “Autopilot is a good thing to have in planes,” you said in an interview, “and we should have it in cars.”

Personally, I’d be happy if you just continue to develop your cars, bring your prices down, and blanket the East and West Coasts with service centers and charging stations. That way, if you don’t become the next Henry Ford, at least you would be the next Walter Chrysler. To top of page

– See more at: http://money.cnn.com/2013/06/12/autos/tesla-elon-musk.fortune/index.html#sthash.7kxgAvGB.dpuf

Google is now in trouble for spying on everybody. Google is one of the biggest “silent investors” in Tesla.

Elon Musk has admitted to the NY Times that his cars are wired to report your location, route of travel, dashboard settings and other real-time use information back to his office.

It is now also learned that the hands free microphone in the cars can be remote activated and also hacked to listen to everything you say in a Tesla.

That’s nice. It is always good to pay $100,000.00 to someone so they can listen and watch everything you do.

Betty Kornen

New Jersey

Silicon Valley VC’s, Goldman Sachs, Batteries and Afghanistan

When investigative reporters found that Goldman Sachs was involved in almost every single one of the DOE money deals, they had to ask why? How much did GS make in, around and through the whole thing? Who was connected to Goldman Sachs and decision makers? Would they really rig a whole market (and a war?) just to get a few TRILLION dollars worth of lithium cornered? Let’s discuss

“AFGHANISTAN THE SAUDI ARABIA OF LITHIUM”:

Medium Taxpayers’ Office revenue increased 300 Million …

Medium Taxpayers’ Office revenue increased 300 Million …

Opening Afghan minds | HeraldTribune.com – Sarasota Florida …

The Deloitte/Tesla Connection:

Now that the entire California unemployment system online has failed, causing thousands and thousands of people to get evicted, with no end to the problems in sight, investigators look to the source: Deloitte!

The California/Deloitte kickbacks with Sacramento and the associated campaign contributions show why EDD gave the contract for its unemployment system to Deloitte “despite a string of problem projects” across California state and local governments that littered the company’s track record, the LA Times reported late last year. These included: a project canceled after four years by California’s Department of Developmental Services after it figured out the system it paid $5.7 million to Deloitte to develop didn’t work; a project to link California’s court system computers, originally slated to cost $33 million, but canceled because it couldn’t be made to work even after Deloitte pocketed $330 million; a botched payroll system Deloitte developed for the L.A. Unified School System; and a Deloitte-led, botched ERP system development for Marin County, California, among others. California government IT has been very, very good to Deloitte’s bottom line.

Savvy California IT experts are praying that Deloitte’s hand in the California healthcare online system will not pretty much gaurantee failure according to a well-placed Sacramento server consultant. But alas, proving that California’s kickback system is just as corrupt as Washington DC’s. The guy WHO BUILT the COVERED CALIFORNIA Obamacare network, THE IT Director, The H.I.X. TOP GUY, The MAIN GUY: James Joseph Brown Jr.; was just ARRESTED FOR FELONY ORGANIZED CRIME CONFLICT-OF-INTEREST!!!! Just like everything in the Tesla/Fisker/Solyndra scam… everything with these people is about kickbacks, conflicts-of-interest and re-routing of public funds into their own pockets. When James Joseph Brown worked in his previous state position he helped get Tesla and Solyndra tax waivers.

Massachusetts admitted a few weeks ago that its original contract with Deloitte to modernize the state’s unemployment system was “flawed” and allowed Deloitte “to miss deadlines and still charge the state some $6 million more than originally planned,” the Boston Globe reported earlier in the month. Suzanne Bump, the Labor Department Secretary in charge of the contract at the time—who is currently State Auditor—told the Globe she has “no recollection of what was in that contract language.”

It is always amazing how selective amnesia seems to strike government officials whenever they are asked to explain their unexplainable decisions.

Deloitte ran the money for Tesla and “cooked the books” for Tesla, while double-dipping with the DOE to review Tesla’s rigged loan applications, ON BEHALF of THE TAXPAYERS “SUPPOSEDLY” while working with California officials to get Tesla a tax waiver for it’s factory; all the while providing shoddy services while rigging kickbacks… nice work if you can get it. Now let’s see: Which Silicon Valley VC’s have an exclusive relationship with Deloitte and Tesla?????

Andrew D.- LA Times

—————————————

Deloitte under investigation for rigging ANOTHER car company:

Deloitte under investigation over Rover Nearly seven years after the collapse of car manufacturer MG Rover, its adviser Deloitte has been placed under investigation by industry regulators.

Deloitte under investigation over Rover Since the car company collapsed in 2005 taking with it 6,500 UK jobs, the AADB has been scrutinising Deloitte’s role as auditor and adviser to Rover.

By Anna White

A complaint was logged yesterday by the Financial Reporting Council (FRC) over the conduct of the second largest accountancy firm in the UK and its former mergers and acquisitions partner Maghsoud Einollahi.

Tom Martin, FRC executive counsel referred the case to the Accountancy and Actuarial Discipline Board (AADB) to review Deloitte’s conduct as auditors and advisers to various companies in the MG Rover Group sale.

The complaint alleges that in connection with certain transactions, Deloitte and Mr Einollahi “failed adequately to consider the public interest; the potential for there to be different commercial interests between the Phoenix Four, MG Rover Group and associated companies and shareholders; and the conflicts of interest and self-interest threat in relation to advising the Phoenix Four whilst maintaining client relationships with the MG Rover Group.”

The accountancy arbitrators said the investigation is extremely serious, as demonstrated by the amount of time it took to file the complaint against Deloitte (formerly Deloitte & Touche.)

Both the AADB and Deloitte confirmed the inquiry is into the “transactions” overseen by Deloitte not the audit work.

—————————————————-

It turns out Deloitte is in criminal investigations, many, many criminal investigations, worldwide, here is another:

“The aero group of companies called in joint administrators from KPMG on November 2009 after incurring losses that amounted to $11 billion according to KPMG partner Jim Tucker. Prior to the administration, Aero Inventory has appointed auditors from Deloitte to account for the financials of the group.

The AADB’s investigation will cover the processes of ICAEW and Deloitte in preparing, approving and auditing the financial statements of Aero Inventory PLC and its subsidiary Aero Inventory Ltd. In UK for the financial years ended June 30, 2007 and June 30, 2008, respectively.”

Susan l- NYC

———————————————————-

There are hundreds of criminal charges against Deloitte, here is more:

The accounting firm Deloitte audited Bankia before it went public, and now Deloitte is under investigation after a report from the Institute of Accounting and Auditing (the Spanish abbreviation is ICAC) accused the firm of not acting independently and exposed a conflict of interest that could lose Deloitte its business license.

Deloitte audited the accounts of all the savings banks that were nationalized to make Bankia, and during the 2008-2012 period it billed them 67.22 million euros. It is notable that after the crisis that many of them endured, only Bankia has severed its relationship with Deloitte.

It is a good thing that the ICAC is demanding excellence from accounting firms, because increased regulation and oversight in the financial sector doesn’t mean much if we don’t make the banks do their jobs well.

One has to wonder who allows these people to even exist after all this has emerged?

Deloitte just makes nice powerpoints for big fancy pitches, takes the money, gives out bonuses and then the “partners” “retire” before everybody sees that the emperor has no clothes and everything comes crashing down!

——————————————–

TV show on DELOITTE CORRUPTION:

https://www.youtube.com/watch?v=gCrxETPMdiY

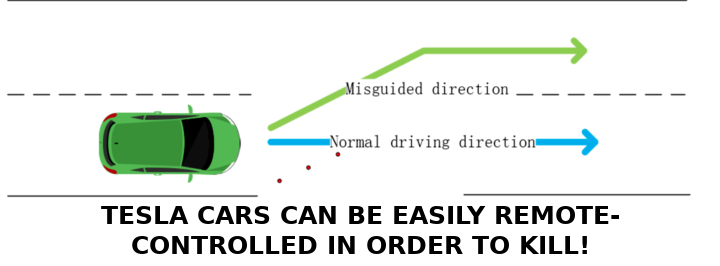

App Authentication Flaw Creates Tesla Motors Hack Concern. Your Tesla can spy on you and drive you off the road on command.

While Elon Musk has admitted to the New York Times that he can spy on any Tesla at any time, personally, the story gets worse:

The Tesla Model S is such an advanced automobile it even comes with its own mobile authentication vulnerability.

According to George Reese, Senior Distinguished Engineer and Executive Director of Cloud Computing at Dell, there’s a flaw in the REST API used in Android and iPhone apps that connect to the car. While he stresses one cannot crash the car with this, one could cause excess electrical usage and force excess wear on batteries.

(ED. At the DEFCON hacker conference, though, other hackers demonstrated a system to take over the GPS which could be used to crash the car by suddenly turn inputs or cruise control bursts. To be safe, have your GPS and all transceiver chips removed from the car.)

He notes that “[a]uthentication happens when you call the /login action with the email address and password of the Tesla customer. This is the same email address and password used to log in to www.teslamotors.com. Every customer has one because this web site is where the customer builds their car.” He then cites five vulnerabilities: “It requires the sharing of the user’s password with third-parties (major); no mechanism exists for cataloging applications with active tokens (significant); Only an inconsistent blunt-force mechanism exists for revoking access to a compromised application (moderate); No mechanism exists for revoking the access of a compromised application (major); The automated expiration of tokens in 3 months encourages applications to improperly store your email and password (significant).

By Robert Vamosi

———————————————

In another Tesla failure, the doors of the car can be electronically hacked to not only lock you out of your car but LOCK YOU IN YOUR CAR. There are a number of published complaints online about the ongoing lock-in of Tesla owners.

K.G. – Dallas

“THE TEST”: Busted!!!!

We ran a little test with the help of some amazing quantitative analysis students from Boston.

A number of the SOMO writer/reporters were noticing the number of stories commenting that “Tesla was in bed with Google backers”. While there are some forensic facts and factual history which seems to lean towards this assumption, the only hard case evidence is in investigators files, which have yet to be unsealed.

So, just for laughs, we created a web metrics plot of the top 20 domestic news aggregation sites in America. Using commonly available “big data” analysis software we plotted a month’s worth of news coverage for all domestic stories with a high readership. You, or your paper, can try this too.

Then we trolled one of Tesla’s PR staff about covering up the November fire. Of course, as Tesla staff often do, they went ballistic and fired off the Teslammer PR Machine. (which involves no clear thinking, planning or logic. In most cases; just Elon’s brand of visceral Frat boy dick waggin’)

But we were watching and tracking the web with the same kind of software Google uses on you. It’s all legal, it’s just icky.

First, We were able to document the timing sequence and identities of each of the Tesla shill stock aliases meat-puppet bloggers as they re-percussed their cover story along the web routes to try to convince investors “…nothing is wrong, walk on, nothing to see here.” There are a very specific group of names and routes we were able to track in 4 different “fire-drills” we monitored.

Second, and of the most interest, of all 20 other news sites in America, the only one to put any mention of Tesla above the 2% coverage mark was: Google News!

Everybody else put tornadoes, Syrian atrocity, job crisis, medical alerts and all kinds of actual really important stuff right at the top and in the lead sections, just like you might think an uncompromised media journal might do.

But Google.. ahhh Google, …Google punched any, and every, mention of Tesla to the top section as if Aliens had landed on Elon Musks front lawn or China had Invaded Fremont, California. Google News put it over 2000% higher, or more visible, THAN ANY OTHER PUBLICATION in the US, maybe even the world. Kinda fishy! Who says those Google searches are rigged?

Of course any negative stories about Tesla were dragged to the back page search results, but only on Google, all 19 other papers showed equal mixes of negative and positive coverage. We are going to try a 3 month monitoring now and see what happens. We are shipping the results off to the known agencies investigating the kick-backs in all this.

Kind of interesting isn’t it?

Dj- LAT. JKen- LAS

HA! Touche’ Now get those college kids to check the whole DOE budget!

DFH-

———————————–

Want to make Elon go nuts?

Say “Fire” and “Your girl-friends and ex-wives ditched you because they said you suck in bed” and you will pretty much trigger all of his machismo hot buttons. He is so arrogant he will go off the rails. Did you see him cry on 60 Minutes when the big astronauts said he can’t play with their spaceships? He is the most immature man I ever met.

;-)- Dana

———————————–

His whole Hyperloop crap thing was just counter PR to try to stave off the truth about the fires!

GG

————————————

Google may bias search results, US senate subcommittee hears

Deadly fires. Deadly vapors released by Tesla Fires. Lithium Ion cars burn homes down. Spontaneous Combustions. Overseas workers die from making Tesla batteries. Fisker Cars Lithium Ion Explodes one-after-the-other. Multiple Tesla Fires Unreported. Boeing 787 proves Lithium Ion is unfixable. Where will it end?

Multiple TESLA cars bursting into flames as batteries turn into potential DEATHBED of lithium explosives and brain damaging, cancer causing dust particle combustion clouds, as predicted: Fisker already gone because of vast number of fires. COVER UP. Tesla not reporting all incidents.

According to transportation group investigators: ” the fire immediately filled the cockpit and passenger area of the car with toxic post-combustion lithium particles and plastic fire vapors which are known to cause cancer, lung damage and brain damage.” All this death and destruction so some silicon valley VC’s can get their quick profits at the expense of the lives, safety and homes of the public and workers.

—————————————————-

TRADE MEDIA MAGAZINE:

Tesla Motors Inc (NASDAQ:TSLA) Faces Tough Time With Flawed Car Design Models

Dallas, Texas, 10/07/2013 (ustrademedia) – Leading automobile company, Tesla Motors Inc (NASDAQ:TSLA) has been in the news for the wrong reasons because some of its cars were involved in battery fires. Tesla may face some major liabilities, if such accidents occur again. They are mainly happening because of flawed design. The cars were termed as “safest on the road” and it is rather ironical that the cars have been catching fires.

There has been speculation regarding whether Tesla needs to recall the vehicles with flawed design. There are a lot of different factors and parameters that will be analyzed before any such decision will be taken.

It is likely that the improper location of the battery and the poor design that has been used in making the Tesla cars is the cause of such accidents. It is still unknown as to what would be the long term impact of using such cars and it is likely that the federal government will set up a committee for investing the same. This news of fires in automobiles has created a major setback for Tesla and it has the potential to mar the reputation of the company.

The company is not sure about opting for an automobile recall; however should they decide to do so, it is a proof that the company is more bothered about the safety of its users rather than focussing on how it can impact the reputation of the company. If the number of such cases keeps on increasing, Tesla can face an extremely tough time and the right action must be taken to sort out the different problems.

It is up to Tesla to decide the right course of action that must be taken. Despite being such a giant in the field of automobile, the recent news has taken the sheen away from the company and it can have huge repercussion on reputation, sales and overall output as well. Tags: NASDAQ:TSLA, Tesla Motors Inc (NASDAQ:TSLA)

-Sally Murdock: a former newspaper section editor and reporter and is now contributing at UStrademedia. Her work has been published in national business trade magazines, and can be found on wire services, in daily newspapers, in university alumni magazines, on the web, in newsletters.

———————————————————————

Elon Musk says his batteries are “safer than gasoline” but he lies!

His batteries explode, burn and give off lethal powder vapors simply by coming in contact with WATER, AIR or CRASHES! (Cuz no cars are ever exposed to those most basic aspects of being a car!)

Musk was offered other safer energy storage systems when the car was designed by Martin Eberhard but Musk turned them down in order to provide kickbacks to investors who also got DOE money for their battery companies, both of which deals the notoriously corrupt Goldman Sachs packaged up. Toyota and ZAP have been selling more electric cars than Tesla ever will and they told Musk not to use those kinds of batteries but he has his kickback deals he wanted to run.

It is Ok to buy a Tesla but it is ESSENTIAL that you live in an area without one single pothole or bump in the road or anything that you might drive over, or water, or air or anybody else that drives a car, IF YOU OWN A TESLA, in order to avoid having yourself, your family, your car and your house not go up in flames and spew dangerous vapors.

—————————————————

UNCOVERED:! Tesla’s own government documents, which Tesla authored, which disclose the horrifying reality of their batteries in Tesla Motors own words:

“”Thermal runaway is of major concern since a single incident can lead to significant property damage and, in some circumstances, bodily harm or loss of life. When a battery undergoes thermal runaway, it typically emits a large quantity of smoke, jets of flaming liquid electrolyte, and sufficient heat to lead to the combustion and destruction of materials in close proximity to the cell. If the cell undergoing thermal runaway is surrounded by one or more additional cells as is typical in a battery pack, then a single thermal runaway event can quickly lead to the thermal runaway of multiple cells which, in turn, can lead to much more extensive collateral damage. Regardless of whether a single cell or multiple cells are undergoing this phenomenon, if the initial fire is not extinguished immediately, subsequent fires may be caused that dramatically expand the degree of property damage. For example, the thermal runaway of a battery within an unattended laptop will likely result in not only the destruction of the laptop, but also at least partial destruction of its surroundings, e.g., home, office, car, laboratory, etc. If the laptop is on-board an aircraft, for example within the cargo hold or a luggage compartment, the ensuing smoke and fire may lead to an emergency landing or, under more dire conditions, a crash landing. Similarly, the thermal runaway of one or more batteries within the battery pack of a hybrid or electric vehicle may destroy not only the car, but may lead to a car wreck if the car is being driven or the destruction of its surroundings if the car is parked.

-Tesla Motors, Filed. U.S. Patent Office””

—————————————————-

Tesla batteries combined with fire and tesla plastics = slow death sentence.

When the lithium ion batteries catch on fire they set the rest of the car on fire. When the batteries are on fire they release deadly chemicals all by themselves. When the Tesla batteries AND the Tesla car are on fire they release a vast deadly cocktail of chemicals that instantly invade your body via your lungs, skin, hair, tear ducts and stay in your clothes. You, your baby in the back seat, nearby observers, first responders and everybody nearby are instantly toxified with a time bomb of poison that make take years to kill you or destroy your health but they will.

Do you enjoy breathing N-methyl pyrrolidinone, ethylene carbonate, ethyl methyl carbonate, dimethyl carbonate, cyanide, and biphenyl and having your brain cells eaten away? Ask Elon Musk on live TV to WARRANT that a burning Tesla does not instantly releases severely toxic chemical vapors! He won’t say it because he knows that the car is a deadly design.

DD-

——————————————————————————————

At the Tesla Factory in Fremont California, Tesla assembles and tests in battery packs, which cover the entire floor of the passenger section, in a military-class ballistic “BLAST CHAMBER” as shown in photos at:

http://lithium-ion.weebly.com

Tesla had previous published requests for patents, now uncovered and published publicly, which state that Tesla felt its batteries had a severe explosion risk and a suspected ability to burn your home down. In spite of Telsa’s knowledge of this hazard, it never adequately disclosed this to buyers.

http://static3.businessinsider.com/image/524c7d5369bedd842edc40a0-482-361/tesla-58.jpg

Firefighters have now confirmed that the Tesla SIMPLY HIT A BUMP IN THE ROAD and the deadly LITHIUM ION Batteries in the TESLA exploded into flames, then, when firefighters tried to put out the fire, the lithium ion batteries which explode in water, blew up some more as the water turned them into a deadly inferno which melted the very metal of the car, as they did with millions of dollars of Fisker cars.

It has been charged that Tesla bribed consumer reporting officials to get their “high safety rating” when Boeing Jets had already proven that the batteries that Tesla uses make Tesla’s deathtraps waiting to happen.

Share this story with this link: http://wp.me/p2BJXK-b2

Watch this movie, one of many of Tesla Cars On Fire:

http://www.youtube.com/watch?v=uFl8v1lxH0k

https://youtube.com/watch?v=q0kjI08n4fg

http://www.youtube.com/embed/q0kjI08n4fg

Many news articles such as:

…pointed out that Tesla batteries are warned to explode in Tesla’s own patent filings, FAA investigations, university studies and more.

PT- AskNews

——————————————

Tesla COVERING UP regular fires with its cars. Even fires breakout with it’s batteries at it’s own factory:

http://forums.mtbr.com/california-norcal/smokes-coming-out-tesla-757766.html

—————————————–

Video of Model S on fire takes down Tesla stock

October 2, 2013, 4:27 PM

Tesla Motors Inc. TSLA shares tanked after a video of a Model S on fire circulated on the web, prompting the electric car company to move quickly to douse the flames of bad publicity.

Elizabeth Jarvis-Shean, director of global communications at Tesla, confirmed that the vehicle engulfed in flames was indeed a Tesla but stressed that the driver walked away without injuries.

————————————————-

Tesla Issues Statement On Fiery Car Crash That Caused The Stock To Tank

Mamta Badkar Oct. 2, 2013,

tesla

Aj Gill via YouTube

Tesla’s stock was down over 7% to a low of $175.40 today, but pared some of its losses to close down 6.24% at$180.95.

It appears that shares began to tumble in the last half hour on reports that a Tesla Model S car caught fire on Washington State Route 167.

Some speculated that the video highlights problems with the car’s battery. Though others rushed to point out that the battery is located in the back of the car.

————————————————–

Here is yet ANOTHER Tesla fire danger, Tesla has publicly stated they have had no fire incidents but the many incidents shown on this page, all different incidents, prove that is a lie:

http://www.engadget.com/2010/10/04/tesla-recalls-439-roadster-2-0-and-2-5-electric-cars-due-to-fire/

—————————————–

Engineer Mark Schrader calls Tesla: “Liars”. Challenges them to live debate on CNN.

Schrader charges that “Tesla knew that Fisker Lithium Ion batteries were spontaneously exploding and nearly always explode when they get wet and that Tesla batteries explode too when wet or damaged in a wreck, releasing deadly toxic materials during combustion or explosion.” Schrader shows that Tesla filed patents, in Tesla’s own name, stating as fact that their batteries could explode with devastating results.

Scrader shows extensive U.S. Department of Energy tests and studies from 5 different DOE national labs which clearly show the toxic, explosive, water-exploding, crash-exploding nature of the particular size, type and use of Lithium Ion batteries in a vehicle traveling more than 2 miles an hour: Deadly consequences were known, and documented before Tesla even got funding.

Mr. Schrader says “Tesla has been using every spin technique in the book and is constantly changing their story on what is happening but the bottom line is: they lied to the public and the stock “analysts”, who are helping them break SEC laws, are telling felony-grade lies too.” Schrader notes that “even though Tesla has had multiple recalls and other fire-on-board incidents, and that Tesla knew of these dangers, they kept selling themselves the batteries because their investors have kickback schemes in the associated battery business.”

THE QUESTIONS ELON MUSK REFUSES TO ANSWER ON LIVE TV-

Some of Schrader’s questions for CNN to ask Tesla during the debate:

“1. How many customers have ever been in a wreck in a Tesla?

2. How many of those cars show burn damage?

3. Was there ever a fire at any of the Tesla plants? How many fires?

4. Why does your patent say your battery’s can cause death and the destruction of a family home yet you still sell them?

5. Why are your batteries assembled and tested in a military grade blast chamber in Fremont?

6. What happens to any of your employees who inhales lithium ion powder? How does your insurance cover them? When factory workers assemble the batteries from raw materials, what insurance covers them? Can these batteries be built from the ground up in California or is that still ILLEGAL because of how toxic they are? These batteries are not out-sourced to China (where you can kill factory workers in the factory process) are they?

7. What happens to any of your customers or fire fighters that inhale lithium ion powder or burning powder combined with burning plastic and aluminum residue? How does your insurance cover them?

8. Did you have any movies or technical white papers about lithium ion battery danger that you viewed prior to applying for taxpayer funding?

9. Which of your investors have a business interest in your battery and battery parts suppliers? Did they file campaign disclosure documents with the FEC? Which of them have a business relationship with EPRI?

10. When you reviewed the Northwest Labs and Battelle lithium ion studies in 2007, why did you not follow their recommendations? When you were told that “the most dangerous thing you can possibly do with lithium ion is pack it in a dense box in a high mass large moving object”, why did that not resonate?”

TD- WashPo

————————————————————————–

See Fisker Exploding Electric Lithium Ion in their cars at:

http://lithium-ion.weebly.com/uploads/1/1/1/4/11141100/1358714100.png

————————————————–

The way Tesla has the batteries made is WORSE than Apple’s Foxconn disaster.

Workers are suffering deadly toxic poisoning effects that Tesla tries to hide offshore. The lithium ion in the batteries is NOT the same kind of lithium the drugstore has. The Tesla version in the batteries is a deadly toxic mix of chemicals in a fine powder and gas. Workers inhale this and get it on their clothes and die about 10 to 15 years later. Making Lithium Ion cores overseas: it’s the problem that solves itself!. The evidence dies off rapidly. Sad.

Robert- National Geographic Researcher

—————————————————-

OH LOOK, OTHER, DIFFERENT-THAN SEATTLE FIRES IN TESLA CARS. And MUSK said there have never been fires….

——————————————————–

http://nlpc.org/stories/2013/10/04/tesla-fire-about-rushing-subsidizing-immature-technology-not-stock-price

Tesla Fire is About Rushing, Subsidizing Immature Technology, Not Stock Price

Printer-friendlyEmail to friendA fire (screen capture from Jalopnik.com) that torched a Model S from the formerly Teflon Tesla Motors on Tuesday blackened its front end, lowered its stock price, and (further) revealed a corporate arrogance not seen since Fisker Karmas were alight.

But CEO Elon Musk saw to it that taxpayers were fully paid back their $465 million Department of Energy loan, so as watchdogs over the public purse we can forget all about it and just go on about our business – right?

Wrong. The incident near Seattle still should be of great concern because Tesla still heavily depends on tax breaks (like the consumer’s $7,500 federal credit) and the sale of emissions credits (mainly from California) to partially subsidize the costs of their electric cars. Moreover, the government has invested billions of dollars in the research and development of new battery technology, all in the name of energy efficiency in order to save the world from global warming. Those based on lithium have gone up in flames in planes, plants and automobiles.

One of these days there will be a fatality, but until then manufacturers dismiss the incidents. The statement Tesla issued about the fire in Kent, Wash. was matter-of-fact and lacked any expression of concern for the vehicle’s owner.

“Yesterday, a Model S collided with a large metallic object in the middle of the road, causing significant damage to the vehicle,” the company response said. “The car’s alert system signaled a problem and instructed the driver to pull over safely, which he did. No one was injured, and the sole occupant had sufficient time to exit the vehicle safely and call the authorities. Subsequently, a fire caused by the substantial damage sustained during the collision was contained to the front of the vehicle thanks to the design and construction of the vehicle and battery pack. All indications are that the fire never entered the interior cabin of the car. It was extinguished on-site by the fire department.”

It almost sounds like Tesla wants an “attaboy” for the brilliance of its safety features and battery design, rather than express how grateful that the driver was not hurt. Whether there actually was a “large” chunk of metal that was struck still isn’t clear from the evidence, but if there was, it’s not a reason for Tesla to be absolved of responsibility. After all, debris is struck in roadways regularly around the country and it doesn’t cause episodes like this. What, for instance, if the Model S had actually collided with an object in the road and it rendered the driver unconscious? Then we’d be talking about a much different result.

Back when Fisker Automotive was still alive and stumbling, their public relations department handled mishaps in a similar fashion. In May 2012 a Fort Bend County, Texas fire marshal attributed a garage blaze to the homeowner’s Fisker Karma, which he had parked shortly before he started smelling burning rubber and discovered the fire. Nevertheless Fisker issued a statement that said, “As of now, multiple insurance investigators are involved, and we have not ruled out possible fraud or malicious intent. Based on initial observations and inspections, the Karma’s lithium ion battery pack was not being charged at the time and is still intact and does not appear to have been a contributing factor in this incident.” The owner was not pleased by the challenge to his integrity.

And after a California Karma fire in August last year, the company said, “We have more than 1,000 Karmas on the road with a cumulative 2 million miles on them. There are more than 185,000 highway vehicle fires in the US every year…No injuries were reported; the vehicle was parked; and the fire was extinguished safely by the emergency services.”

The arrogance isn’t limited to the automotive realm. In April this year Boeing, after a series of “thermal runaway” incidents on its lithium-ion battery-powered Dreamliner, officials announced they gave up trying when it couldn’t find the source of the problem. Instead the manufacturer said they came up with a solution that would both contain a potential fire and vent its heat outside the airplane if another fire happened.

“In some ways it almost doesn’t matter what the root cause was,” said Michael Sinnett, Boeing’s top engineer.

Undoubtedly there are a lot of very smart people who have worked very hard on developing these new technologies. But likewise there have been equally brilliant individuals warning these engineers and entrepreneurs that they are dealing with dangerous materials and chemistry, and that just because someone hasn’t been hurt yet, doesn’t mean it can’t happen.

Lewis Larsen of Chicago-based Lattice Energy LLC has consistently called attention to the problems with lithium ion technologies and their tendencies to thermally run away – or, in other words, burn uncontrollably. The practicality problem (other than their immense cost) with the batteries is that when they experience stress – for any number of reasons – it’s almost like unleashing hell.

“…A battery cell’s electrochemical reactions can suddenly start running at greatly elevated rates that create more process heat than normal thermal dissipative mechanisms can easily handle,” Larsen wrote, “which then starts raising the temperature of battery cell contents out beyond their ideal safe operating range…(eventually) a dangerous feedback loop is created…thermal runaways are thus born….”

For many – perhaps most – people that isn’t the kind of risk you want in your “mobile platform,” as Larsen put it. But rather than emphasize those challenges, most of the media coverage has emphasized what the incident has done to Tesla’s stock price, which irrationally skyrocketed upward this year.

Part of the bombastic investor enthusiasm stemmed from other superlatives bestowed upon the Model S, such as the National Highway Traffic Safety Administration’s top score of five stars, which spurred Musk to make sure the media was told the car scored even higher on some safety aspects. And then in May Consumer Reports’ announced the Model S scored 99 out of 100 – almost perfect!

It was all too much too soon for the electric car with a minimal track record. The doubts and questions about lithium ion batteries used in vehicles and planes – and the massive taxpayer subsidization of them – are still valid.

Paul Chesser is an associate fellow for the National Legal and Policy Center and publishes CarolinaPlottHound.com, an aggregator of North Carolina news.

——————————————————————————————————

How Safe are Lithium-Ion Batteries?

The recent incident of a Tesla Model S all-electric vehicle catching fire is renewing questions about the safety of lithium-ion batteries and their use in transportation applications.

The Tesla story is the second high-profile case this year, the other involving Boeing’s 787 Dreamliner, both of which involve incidents with lithium-ion batteries. The cases are shining a spotlight on the use of lithium-ion batteries in transportation and the challenges designers face in minimizing the risks of battery failure. Is this technology robust and mature enough to be used extensively in transportation applications (such as airplanes and automobiles) while not posing any elevated safety risks?

For right now, the main strategy appears to be one of recognizing the underlying failure mechanism of lithium-ion battery cells and dealing with this possible failure through containment

——————————————————————————

Does Tesla’s Battery Fire Tempt Boeing to Schadenfreude?

The joke about the mixed emotions when ones’ mother-in-law drives off a cliff in your brand-new-car surely must describe how Boeing feels today watching Tesla defend the lithium ion batteries powering its cars.

[youtube http://www.youtube.com/watch?v=OYepYYj6wpM]

He then adds, “Wow, I can feel the heat in here.” That may be the more significant statement which I will get to in a moment.

For now, I want to remind readers that when Boeing experienced two thermal events on Dreamliner batteries in January, prompting safety regulators to ground the airplane for four months, Tesla’s boss, Elon Musk told FlightGlobal that the planemaker’s design was “inherently unsafe.”

Along with others, I’ve been saying that as well. The difference here is that Musk believes his company figured out the secret sauce; more, smaller and more widely separated cells while Boeing was using large, more closely-spaced cells in the Dreamliner.

|

| Celina Mikokajczak at the NTSB hearing on lithium ion battery safety |

This is what makes the batteries on Tesla electric cars safer than Boeing’s electric plane, according to Musk. Celina Mikokajczak, an Tesla engineer explained this and more to the NTSB at a hearing in Washington DC in April.

In order to get the airplanes back in the air, Boeing did create more breathing room between the eight cells per battery on the two batteries on each 787. Boeing also constructed a big box it claims will contain any thermal event and vent any fumes. But whether Musk and his clever chemical engineers (or Boeings’ for that matter) have really tamed the beast is still up for discussion.

Lewis Larsen about whom I have written in the past, is already overheated about the Tesla fire. In a mailing to me today, he writes that the fire “is really a form of thermal runaway” and that far from being the smartest folks in the room regarding lithium ion batteries, the Tesla folks have just been the luckiest.

He wasn’t there of course, but Larsen is concerned that the battery may have caught fire spontaneously because Tesla hasn’t solved the problem thermal runaway problems, nor has anyone else.

Tesla, however, is telling reporters “a large metal object” hit one of the modules on the battery triggering the blaze. This is not a minor distinction as far as Larsen is concerned because he’s telling anyone who will listen that these battery cells go bad without notice and that when they do, they can heat up to nuclear-reaction-like temperatures.

Now, the comment of our citizen videographer, who driving by the flaming $70,000 sedan says, “Wow, I can feel the heat in here,” begins to sound more ominous.

Which is why, Boeing executives may be tempted to feel a bit of schadenfreude now that the negative news spotlight has turned from their airplane to Musk’s fancy car. But that’s going to be fleeting. There’s no reveling in Tesla’s discomfort because when it comes to lithium ion batteries, the heat goes both ways.

————————————————————————————————

See Lewis Larsen’s whole presentation and contact him for interviews, below:

Lattice Energy LLC-On Oct 1 Tesla Model S Caught Fire on Highway-Has Companys Luck Run Out-Oct 3 2013H from Lewis Larsen

Lithium Ion Batteries and Organized Crime

The ultimate goal of a career criminal politician is to run an agency, or top committee, in order to conduit money to friends and keep the lid on cover-ups. Those at the heads of agencies and committees are often the dirtiest of the dirty. They get themselves put there in order to run the scams. Who ran agencies that conduit-ed money and covered up and stalled investigations?

Was Tesla funded not to build cars but to lock-up lithium ion deals for it’s investors?

Why are dozens of conspiracy lawsuits now filed on lithium ion company racketeering?

Why are there multiple “task forces” looking at lithium ion finance relationships?

Why was the Russian mob involved in Lithium Ion mining?

Did all of these people know that lithium ion blows up quite a lot and emits deadly gases?

Let’s discuss…

S- Denver Post, C- NY Times

———————————————

-

Rechargeable Lithium Battery Antitrust Class Action Lawsuit

… Hitachi, LG Chem, Samsung, and Sanyo for allegedly conspiring to fix and raise the prices of lithium–ion rechargeable batteries in violation of U.S. antitrust law …

www.lieffcabraser.com/ Case-Center/ Rechargeable-Lithium-Battery-Antitrust-Class-Action–Lawsuit.shtml – View by Ixquick Proxy – Highlight

-

Complaint

The Defendants’ Conspiracy Stabilized and Raised Lithium Ion …. The subject of this lawsuit and the Defendants’ conspiracy is Lithium Ion Rechargeable.

www.hbsslaw.com/ Templates/ media/ files/ case_pdfs/ Batteries%20Antitrust/ Class%20Action%20Complaint.pdf – View by Ixquick Proxy – Highlight

-

United States – Mondaq.Com

5 Feb 2014 … In the lithium ion battery cells case, the defendant manufacturers argued that the … A direct purchaser subsidiary is unlikely to bring a lawsuit for damages …. 2nd Circuit Rejects DOJ’s “Continuing Conspiracy” Theory In …

www.mondaq.com/unitedstates/article.asp?articleid=291110 – View by Ixquick Proxy – Highlight

-

Lithium Ion Rechargeable Batteries Class Action Lawsuit

Price-Fixing Class Action for Lithium Ion Rechargeable Batteries … agreement, or conspiracy to fix, raise, maintain, or stabilize the prices of these batteries.

www.girardgibbs.com/ lithium–ion-rechargeable-batteries-antitrust-class-action/ – View by Ixquick Proxy – Highlight

-

Patent encumbrance of large automotive NiMH batteries – Wikipedia …

The current trend in the industry is towards the development of lithium–ion …. guilty of conspiring to buy and dismantle the Los Angeles electric street car system, … In August 2008, Mercedes-Benz sued Cobasys for again refusing to fill a large, …

https://en.wikipedia.org/ wiki/ Patent_encumbrance_of_large_automotive_NiMH_batteries – View by Ixquick Proxy – Highlight

-

Lawsuits accuse lithium ion battery makers of price fixing …

12 Nov 2012 … The world’s largest manufacturers of rechargeable lithium ion … are being sued for allegedly engaging in a decade-long conspiracy to fix prices …

www.northjersey.com/ news/ Lawsuits_accuse_makers_lithium_ion_battery_makers_and_North_Jersey_su bsidiaries_of_price_fixing.html – View by Ixquick Proxy – Highlight

-

City Attorney’s Statement Regarding Lithium Ion Battery Anti-Trust …

8 May 2013… are alleged to have conspired to fix prices of Li-Ion batteries that were included in … Palo Alto purchased many devices containing Li-Ion batteries, … These staff costs will be fully reimbursed in any resolution of the litigation.

www.cityofpaloalto.org/ news/ displaynews.asp?NewsID=2236 &TargetID=268, 60, 75, 235, 94, 84, 85, 87, 287, 288, 106, 99, 121, 2, 124, 125, 126, 133, 134, 328, 137, 145, 140, 239, 322, 325 – View by Ixquick Proxy – Highlight

-

Class Actions | Sotos LLP

December 20, 2013, The lawsuit, on behalf of nearly a million Ontario … lithium battery manufacturers and resellers alleging they conspired with each other to …

www.sotosllp.com/class-actions/ – View by Ixquick Proxy – Highlight

-

Lithium Ion battery Antitrust Litigation | Lithium Ion battery Price Fixing

ALLEGED ILLEGAL OVER-PRICING OF LITHIUM ION BATTERIES … into whether certain manufacturers illegally conspired to over-price Lithium Ion batteries …

www.zimmreed.com/Over-Pricing-of-Lithium–Ion-Batteries/63629/ – View by Ixquick Proxy – Highlight

-

USDOJ: Panasonic and Its Subsidiary Sanyo Agree to Plead Guilty …

Jul 18, 2013 … SANYO and LG Chem Ltd. have agreed to plead guilty for their roles in a conspiracy to fix the prices of cylindrical lithium ion battery cells sold …

www.justice.gov/opa/pr/2013/July/13-at-808.html – View by Ixquick Proxy – Highlight

-

Antitrust Investigation – Lithium Ion Rechargeable … – scott and scott llp

Lithium Ion Rechargeable Batteries are used as a power source for … of major securities, antitrust, and employee retirement plan class action lawsuits.

www.scott-scott.com/ cases/ investigations/ securities-fraud-litigation-1771-antitrust-investigation–lithium–ion– rechargeable-batteries.html – View by Ixquick Proxy – Highlight

-

Class Action Lawsuits Mount Against Battery Price-Fixing Cartel

Oct 31, 2012 … Manufacturers of lithium ion batteries face at least 10 class action lawsuits … The plaintiffs allege the defendants entered into the conspiracy …

www.topclassactions.com/ lawsuit-settlements/ lawsuit-news/ 2814-class-action–lawsuits-mount-against-battery-price-fixing-cartel/ – View by Ixquick Proxy – Highlight

-

Class Suits Charge Battery Makers With Global Price-Fixing …

Oct 24, 2012 … Litigation is mounting against the world’s biggest manufacturers of rechargeable lithium ion batteries, who consumers accuse of complicity in an illegal … Class Suits Charge Battery Makers With Global Price-Fixing Conspiracy.

www.njlawjournal.com/ id=1202576057659/ Class-Suits-Charge-Battery-Makers-With-Global-Price-Fixing-Conspiracy – View by Ixquick Proxy – Highlight

-

Antitrust Litigation – Pearson, Simon & Warshaw, LLP

The Los Angeles antitrust litigation lawyers of Pearson, Simon & Warshaw have prevailed in class action lawsuits against major corporations for price fixing conspiracies. … Lithium Ion Batteries: PSW attorneys currently serve as interim co -lead …

www.pswlaw.com/Practice-Areas/Antitrust-Litigation.aspx – View by Ixquick Proxy – Highlight

-

Rechargeable Lithium Battery Antitrust Class Action Lawsuit

… Hitachi, LG Chem, Samsung, and Sanyo for allegedly conspiring to fix and raise the prices of lithium–ion rechargeable batteries in violation of U.S. antitrust law …

www.lieffcabraser.com/ Case-Center/ Rechargeable-Lithium-Battery-Antitrust-Class-Action-Lawsuit.shtml – View by Ixquick Proxy – Highlight

-

A laptop battery cabal: Panasonic pleads guilty to price fixing …

Jul 19, 2013 … Sanyo agreed to pay $10.7 million for the battery cells conspiracy and … into anticompetitive conduct in the cylindrical lithium–ion battery cell …

www.pcworld.com/ article/ 2044740/ panasonic-pleads-guilty-to-laptop-battery-pack-price-fixing.html – View by Ixquick Proxy – Highlight

-

-

-

U.S. Senator: Tesla money came from “one of the most disastrously mismanaged and corrupt programs in U.S. history,”

Rep. Jim Jordan, R-Ohio, chairman of the House Oversight subcommittee where Whitcombe testified, has called the loan program “one of the most disastrously mismanaged and corrupt programs in U.S. history,” and said during that Fisker hearing, “The Obama administration owes the American taxpayer an explanation as to why this bad loan was made in the first place.”

He might also want an explanation why DOE’s Whitcombe and Chu hid the truth about VPG while under oath before his subcommittee.

Tesla owners, investors and their search engine owners paid Washington staff to get false stock impressions and taxpayer funds in order to unfairly and unethically fund Tesla.

So besides the fact that it has now been revealed that Tesla cars spy on their owners while you are driving one, the company was acquired in a hostile takeover, each car has constant mechanical problems, the door handles can lock you in the car, Solyndra and Tesla buildings were corrupt real estate deals, the batteries have to be assembled in a blast chamber because they could explode, and the Tesla people paid to sabotage Fisker and other competitors… the list of bad Tesla things now seems to be record-breaking

Energy Department Staff find that the tracks they thought they covered up were actually NOT covered up… Oops!

As departing energy department staff shredded and deleted as fast as they could, they thought they had covered the tracks of the theft and manipulation of billions of tax dollars which they routed to their friends.. not so much. Every insider phone call, every insider email (even on personal email accounts that they used to hide the process) every conversation in a Washington or Virginia restaurant with security cameras, every conversation in a car.. all documented. Postings by ACLU staff, such as the widely distributed post below, show that every aspect of the energy department “secret” deals is documented, archived and only one subpeona, or one FOIA filing or any investigator demand away from disclosure:

“ACLU CONCERNS OVER WHO SPYS:

As is now widely reported in the news: Any device that is marketed as a “smart device” or ANY electrical device, can be used to track you. Any bored child, hacker or competitor, with easily downloaded software tools, can spy on you using the following methods:

By tracking your utility smart-meter use activity.

By tracking when you cross bridges, or other points, on your bridge toll fastrak device.

By reading everything you ever wrote, read, looked at or clicked on in Facebook, Google, Twitter and any other “social media” site no matter how high you set your privacy settings. Don’t use “social media” if you don’t want to be tracked, and have your experiences processed to sell you ads and lose all of your privacy. Shut off all of your social media accounts. You don’t need any of them. Post this posting in blogs about any “social media”.

By reading any device that your bluetooth can connect to or transmit from, or to. Turn off Bluetooth. If your computer is offline but your phone or tablet is connected to your computer, hackers can backdoor into your computer through any connected device.

By reading your use of, location of use and activity when you use any ATM.

By using any aspect of Google. Google exists simply to spy on, and track people.

By using a parking lot monthly, daily or pay-per-use card or device. Pay by cash.

By logging all of your profile versions and communications on dating sites.

By being in any major city. Every major city has cameras that cross cover every part of the city. The cameras in stores and on buildings are crossed over. Most every bus, police car and many utlities vehicles share their cameras to the common database which any group can access.

By watching you from drones that are so high, or so small, you can’t see them.

By watching what you watch on Netflix, Hulu, Youtube, Comcast, Xfinity and similar media outlets.

By using less than three mouse clicksevery Dell Server, Cisco router, Linksys device, Intel motherboard and Netgear device can be “backdoored” open and every document it is attached to read, opened and acquired.

By making the phone manufacturers Apple, HTC, Samsung, etc. put a secret switch in your phone so they can kill your phone remotely if you start to organize. Buy the oldest phone you can find, without GPS or even a screen. The old ones won’t have tracking chips.

By lasering, microwaving or otherwise bouncing energy off the windows or objects in your home or office to listen to you by recording the air vibrations of those objects that your voice causes.

By reading your location of uses, direction of travel, individual actions, trends in purchases, amounts of purchases and time of purchases for each and every credit card and debit card use.

By intercepting the network application in your car dashboard and watching the people behind you and on the street via the back-up camera in your car.

By using deaf people or specialized computers to read your lips no matter how far away you are or what windows you are behind.

By remote activating any camera on your computer, mobile device, TV, or any other location and watching you while putting fake screen information on your screen so you do not know they are watching you. Remove the battery of any mobile device when not using it. Hacker software makes your device appear to be turned off but it is still alive and watching you.

By reading every email that passes over any server in the world and by logging your passwords for any server.

By looking through walls with wifi distortion field devices, interferometry devices and EMF grid sensors.

By simply turning on software products such as Predator, Carnivore, CALEA, Prism, DCSNET, and over 100 others that exist to automatically acquire every personal information element they can find in an unattended manner.

By monitoring the GPS, Siri, OnStar, Microsoft Sync, Tesla dashboard, Nokia Here Audio and any other networked electronics in your car. Don’t buy a “smart car” if you don’t want to be watched every second you drive it. You can be listened to through it. Your GPs signal can be hacked and rerouted through it.

By reading the GPS, cell phone signal triangulation, bluetooth, Near Field Communications chip, modem or any other signal on your cell phone or table. Remove the battery on any device you don’t want to be tracked on. Only use an old cheap phone with no GPS and no internet capability.

By using fake cell towers called “sting rays”, your cell phone signals can be easily intercepted.

By making the “remember” function of any browser send what it “remembers” back to the hackers.

BY Itunes, Pandora and music services storing your preferences and all use data which can be forwarded to others.

By acquiring all information from lotteries, contests and subscription cards you fill out at expo’s fairs, online and at any other location. Filling out a contest entry guarantees you will end up on the junkmail lists.

By capturing and databasing all of your product exchanges and returns, store and log all of those actions and then hackers, and others, can access their database and pull down all of your records.

and more…

—————————————————————-

While the stated purpose is to “stop crime”, in many cases the information acquired, as we now learn from the IRS data manipulations, is used by some to stop, delay or harm those who have conflicting points of views. The statement that it is “legal” is mitigated by the fact that it now only costs $50,000.00, or less, to buy a “law” or “policy” in Washington. Corporate lobbyists buy them every day. Corporations and political operatives have the same agenda: To use you for their purposes. So they are not motivated to fix it.

The proven “targeting” of political adversaries by the IRS, and others, shows that, given the chance to use the system against those with other views, they always will.

Tesla “Battery Swap” a smoke-screen to get rid of exploding battery pack

Tesla has been scrambling to address the issues that killed Fisker, namely, that their batteries can explode and burn you, your kids and your house up in a big nasty fireball.

SEE:

Tesla gets another $34M of your tax $$$ in campaign finance kickbacks.

Part of a number of lawsuits currently filed on Tesla note that Tesla books tax giveaways as “profit or revenue” instead of selling cars it has made a business out of taking tax money. Today, the State of California revealed that Tesla had received another $34 million in a one-of-a-kind, exclusive kickback of taxpayer money to help a bunch of billionaires who just happened to be the same billionaires that financed the related campaigns! Amazing!

DG- Bost

——————————————————————————

Tesla just got a $30-million tax break

By Giuseppe Macri- Daily Caller

The state of California just approved a $34.7-million tax break for electric car manufacturer Tesla Motors to expand the company’s production capability by another 35,000 additional units per year.

As a result, Tesla will be exempt from paying sales and use taxes on its planned purchase of $415 million in new manufacturing equipment, which California estimates will result in a $24-million economic boon to the state’s economy.

The California Alternative Energy and Advanced Transportation Financing Authority was the state panel that authorized the tax break. The panel is chaired by California state Treasurer Treasurer Bill Lockyer.

——————————————————————————–